Military Retirement State Tax Calculator

If you're searching for picture and video information related to the keyword you've come to visit the right site. Our site gives you suggestions for viewing the maximum quality video and picture content, hunt and locate more enlightening video articles and graphics that fit your interests.

includes one of thousands of movie collections from various sources, especially Youtube, therefore we recommend this video that you see. This site is for them to visit this site.

State taxes are a different story.

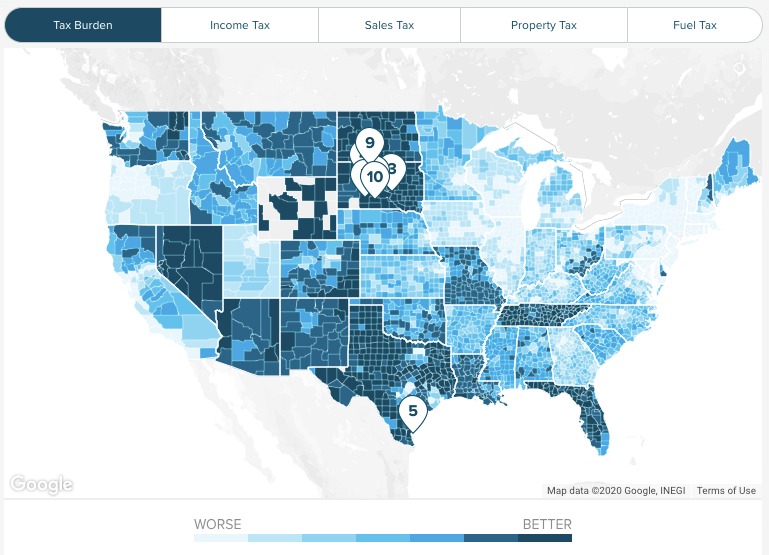

Military retirement state tax calculator. If you receive or the spouse of a military retiree receives military retirement income you will be able to subtract up to 5000 with an increase to the first 15000 for individuals who are at least 55 years old on the last day of the taxable year of your military retirement income from your federal adjusted gross income before determining your Maryland tax. This calculator provides a comparison between the Legacy High-3 vs. Our analysis assumes a retiree receiving 15000 from Social Security benefits 10000 from a private pension 10000 in wages and 15000 from a retirement savings account like a 401k or IRA. You should consider your situation based on your state of residence.

Military Retirement Compensation Calculators. Another nine states dont tax personal income of any kind military or civilian. See compensation by month and annually. If you joined between Sept.

Death Gratuity New Retired Benefits Program Office of the Actuary. North Dakota proudly joins 20 other states that currently exclude military retirement benefits from income tax Beginning with the 2019 tax return a new line on the North Dakota income tax return will be dedicated to the. Military Pay Calculator Use the Military Pay Calculator to see your current past and proposed future military pay by rank location and branch of service. For example Colorado excludes up to 24000 of military retirement pay depending on your age.

With the passage of House Bill 1053 North Dakota resident taxpayers are now exempt from paying income tax on their military retirement Rauschenberger stated. Except for the retirement choice calculator which is a US army retirement calculator provided offsite the calculators provided in the above list specifically by Military Pay are very straightforward and easy to use. Maryland Military retirees dont pay state income taxes on the first 5000 of their retirement income. 8 1980 and July 31 1986 you can use the High-3 Calculator to figure out your estimated base pay.

Up to 2000 of military retirement excluded for. The Blended Retirement System BRS. The Military Officers Association of America MOAA is the countrys leading organization protecting the rights of military servicemembers and their families. Calculate how much tax youll pay when you withdraw a lump sum from your pension in the 2019-20 and 2020-21 tax years.

Starting in 2022 all military retirees may exclude 50 percent of their military retirement benefits. Other Withholdings from Your Military Pension. A military retirement calculator or military reserve retirement calculator that uses this plan will practice the same principles as the High-36 plan except each year short of 30-year career results in percentage reductions. Calculate how much tax relief you can get on your pension in the 2020-21 tax year and see how it compares to 2019-20 and 2018-19.

MOAA members proudly hail from every branch of the. Up to 15000 of military basic pay received during the taxable year may be exempted from Virginia income tax. Military retirees can elect either a 40 percent exclusion of military retirement income for seven consecutive tax years or a 15 percent exclusion for all tax years beginning at age 67. For those who retired after 1997 military retirement pay is subject to state tax when the pay exceeds 31110.

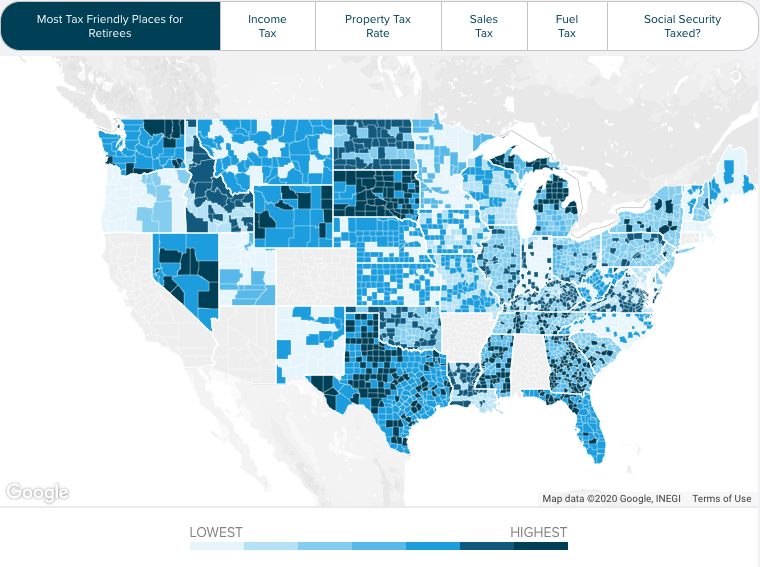

Those who belong to MOAA not only lend their voices to a greater cause but they also gain access to extensive benefits tailored to the needs and lifestyles of military officers. You simply input your information and a calculation of your estimated retirement earnings are provided to you instantly. Military retirement calculators for retirement pay BRS High-3 Redux COLA Thrift Savings Plan by service comparison calculators and much more. Methodology To find the most tax friendly places for retirees our study analyzed how the tax policies of each city would impact a theoretical retiree with an annual income of 50000.

There are 23 states that either dont have an income tax or dont tax military retirement pay and over 20 that offer special considerations on pensions or military retirement income. Factors such as the year you entered service and your retirement type also affect your pay. BRS Comparison Calculator BRS Calculator High-3 Calculator Final-Pay Calculator REDUX Calculator RMC Calculator SCAADL Calculator Benefits. The amount generally is based on your length of service or your disability percentage.

The calculator includes all Regular Military Compensation RMC including Base Pay BAH BAS and which portions that are taxable and tax-free. Blended Retirement Comparison Calculator. An additional 13 states have partial exemptions. Twenty states do not tax military retirement income at all.

RMC Calculator - RMC represents a basic level of compensation which every service member receives directly or indirectly in-cash or in-kind and which is common to all military personnel based on. This retirement plan offers a pension after 20 years of service that equals 25 of your average basic pay for your three highest paid years or 36 months for each year you serve. Military Retirement Calculators The Department of Defense uses a multi-step formula to compute your retired pay. Basic Pay Special and Incentive Pays Allowances Tax Information Recoupment Retirement Calculators.

Use our pension calculator to work out how much.