Military Retirement Pay Federal Tax Calculator

If you're looking for video and picture information linked to the keyword you have come to pay a visit to the right site. Our website gives you hints for viewing the maximum quality video and picture content, search and find more enlightening video articles and graphics that fit your interests.

comprises one of thousands of video collections from various sources, especially Youtube, therefore we recommend this movie for you to view. This site is for them to stop by this website.

If you entered active or reserve military service before September 8 1980 your retired pay will be based on your final basic pay.

Military retirement pay federal tax calculator. However if you are. Members may be eligible for these retirement payments or a smaller averaged amount categorized as High. REDUX Calculator - This calculator estimates your retirement benefits under the REDUX retirement plan for those who opted for the Career Status Bonus at 15 years of service but are not yet retired. Federal Income Tax Withholding.

Additionally if youre retiring after exactly 20 years then 2 years pay will be at 18 years and 1 year will be at 16 years your 17th year. 2020 Reserve Drill Pay chart. Military Retirement Calculator - Compare military retirement pay against different retirement dates and ranks estimate future pay for 40 years after retirement and automatically calculates early retirement pay if you enter a retirement date that is less than 20 years of service. If you joined between Sept.

Military Civilian and Retiree Pay. Retirement pay is taxable at both the state and the federal level. Final Pay Calculator - This calculator estimates your retirement benefits under the Final Pay retirement plan for those members who first joined prior to September 8 1980. This retirement plan offers a pension after 20 years of service that equals 25 of your average basic pay for your three highest paid years or 36 months for each year you serve.

The amount withheld is dependent upon the taxpayers amount of wages and the number of exemptions. And look up your basic allowance for housing on the Defense Travel Management Offices BAH calculator. Instead of receiving a W-2 from an employer in January of each year military retirees receive a Form 1099-R from the Defense Finance and Accounting Service in Cleveland. If you entered active or reserve military service after September 7 1980 your retired pay base is the average of the highest 36 months of basic pay.

This calculator will compute your regular military compensation based on your inputs. 8 1980 and July 31 1986 you can use the High-3 Calculator to figure out your estimated base pay. What is the federal tax rate on military retirement income. Redux pays only 40 percent for a 20-year retiree.

Under High-36 DFAS will calculate the highest 36 months of pay into the retirement calculation. For a 20-year military career High 3 provides retirement pay equal to 50 percent of your average basic pay over your three highest income years. See compensation by month and annually. Regular military compensation is the approximate amount of an equivalent civilian salary.

324330 20 Years 64866 64866 25 162165. Basic Pay Number of Years Active-Duty 25. If youre retiring after 2 years TIG that means 1 year of your lower paygrade goes into this calculation. Military Retirement Pay Military retirement pay based on age or length of service is taxable and must be included as income for Federal income taxes.

Your highest 36 months pay will be. Approximately 998 accurate for final military reti. Office of Personnel Management 1900 E Street NW Washington DC 20415. 2020 Active Duty Basic Pay chart.

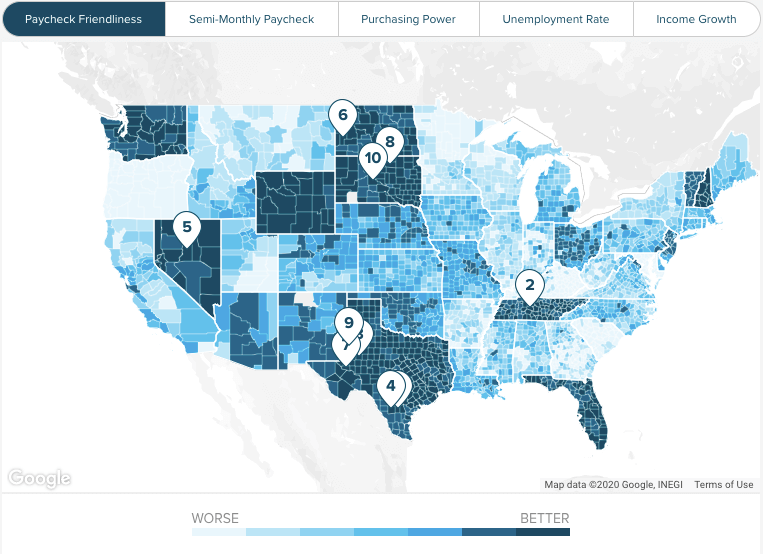

Most states in the 21st century have offered either a total tax break for qualifying veterans or some form of a tax exemption for retirement pay. Generally payment you receive as a member of the military is taxed as wages. This information establishes the marital status exemptions and for some non-tax status we use to calculate how much money to withhold from your taxable income for your annual tax. That will increase to 50 in 2020 75 in 2021 and 100 for taxable years beginning after 2021.

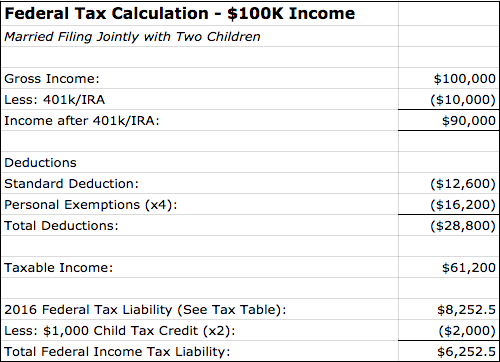

How accurate are your formulas. For example if an individual is an E-6 with 20 years of military service and a basic pay of 324330 per month the equation would run. Your federal income tax withholding or FITW is determined by the DD Form 2656 you completed at the time of your military retirement or by subsequent W-4 Form on file with DFAS. Use that information to update your income tax withholding elections on our Services Online retirement tool.

The 1099-R lists the total of your taxable retirement pay and the amount of federal tax that was withheld for the past calendar year. Y Form W-4 Employees Withholding Certificate - Used for wages and military retirement pay y Form W-4P Withholding Certificate for Pension or Annuity Payments - Used for pensions and. Most military retirement pay is treated and taxed as normal income but in certain cases it can be excluded In the eyes of the federal government military retired pay is no different from any other form of income which means that you have to pay income tax on it. Military Pay Charts and Military Retirement Calculators.

Military Pay Calculator Use the Military Pay Calculator to see your current past and proposed future military pay by rank location and branch of service. The calculator includes all Regular Military Compensation RMC including Base Pay BAH BAS and which portions that are taxable and tax-free. Up to 6250 plus 25 of retired pay over that amount is tax-free for 2019. Ax T Withholding You can request federal tax be withheld from your pension social security unemployment compensation etc by submitting the appropriate following form to the payer of the income.

Federal income tax rules require retirement pay including military retirement pay to be considered for taxation. To calculate estimating retirement pay.