Military Retirement Division Formula

If you're looking for picture and video information linked to the key word you have come to visit the right blog. Our site gives you suggestions for viewing the maximum quality video and image content, hunt and locate more informative video articles and graphics that fit your interests.

includes one of tens of thousands of video collections from various sources, especially Youtube, therefore we recommend this video that you view. You can also contribute to supporting this website by sharing videos and images that you like on this site on your social networking accounts such as Facebook and Instagram or educate your closest friends share your experiences concerning the simplicity of access to downloads and the information that you get on this website. This site is for them to stop by this website.

Will ick is the principal of the Will ick L aw Gr oup an AV rate d Family Law firm in Las Vegas Nevada.

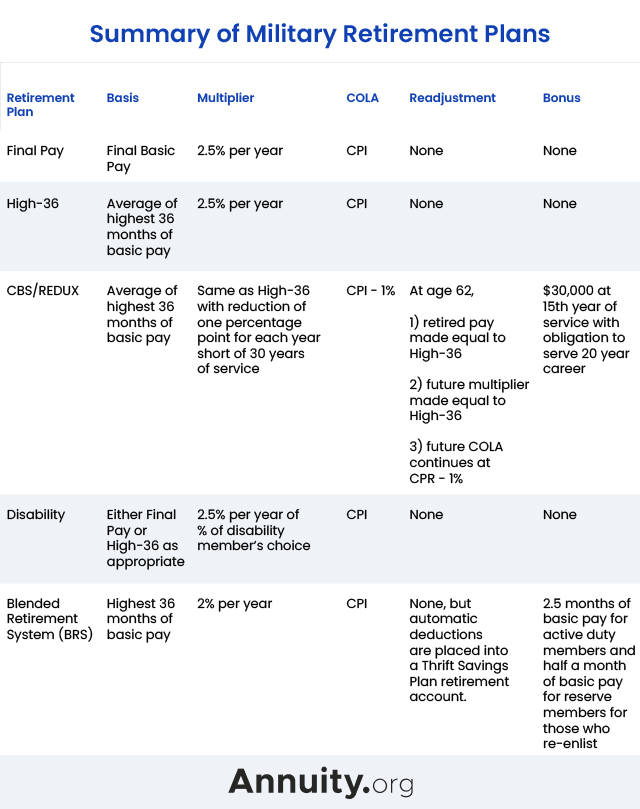

Military retirement division formula. SILENT PARTNER is a lawyer-to-lawyer resource for military legal assistance attorneys and civilian lawyers published by the Military Committee of the American Bar Associations Family Law Section and the North Carolina State Bars military committee. Former Spouses Protection Act and division of military retirement benefits. Military Retired Pay Division Order on or before December 23 2016. The former spouse is awarded a percentage of the members disposable military retired pay to be computed by multiplying ____ times a fraction the numerator of which is _____ Reserve retirement points earned during the period of the marriage divided by the members total number of Reserve retirement points earned.

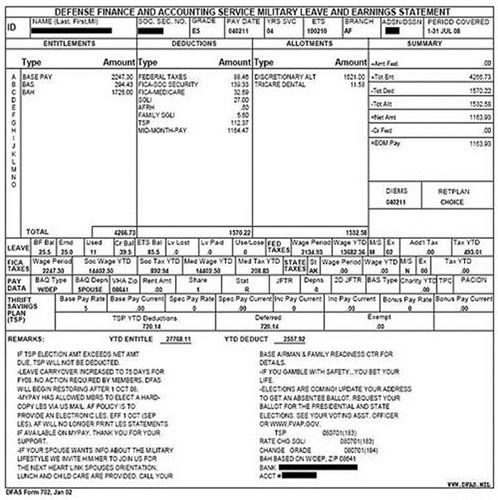

AM is a family of division formulas that are plug-n-play replacements for the complicated DFAS methods that exist for both Reserve and Active Duty retirements. DIVISION OF MILITARY RETIREMENT BENEFITS IN DIVORCE by Marshal S. The rewrite requires that the military retired pay to be divided will be that attributable to the rank and years of service of the military member at the time of the parties divorce. In order to use military retirement benefits for child or spousal support a certified court order must be served on DFAS.

The numerator is the total number of months or years the parties were married during the service members creditable military service. A formula is an award expressed as a ratio. Division of Military Retired Pay After Retirement The portion of the retired pay that is considered marital property can be defined as a fraction. The main change this federal act made was limiting the cut off date of the denominator to being the service members overall military service up to the date of dissolution and not the future actual retirement date of the military member.

101 Las Vegas NV 89110-2198 702 438-4100 fax. A formula award is stated as a marital fraction in which the numerator and denominator are multiplied by a given percentage. The new military pension division rule is a rewrite of the terms for military pension division found in the Uniformed Services Former Spouses Protection Act or USFSPA 10 USC. A state court can divide retired pay in any way it chooses.

There are some limits on the payment of military retired pay directly to former spouses by DFAS. A marital shared asset divided at divorce must be caclulated so it does not go up in value because one party does more work after divorce. Willick WILLICK LAW G R OU P 3551 East Bonanza Rd Ste. At the same time AM can divide military retirement assets in marriage situations that DFAS methods simply cannot do.

Contrary to popular belief there is no magic formula contained in the act to determine the appropriate division of retired pay. Military retirement benefits can be divided as a marital asset and can also be used as a source of child and spousal support. The date of marriage the date of separation the dates. Creditable service numerator to the members total service that is creditable toward retirement denominator.

This is so even. This is known as the Frozen Benefit Division because the non military spouses share is fixed or frozen and will not increase after the date of divorce. Please send any comments corrections and suggestions. If the member is already retired it is best to structure the military retirement award in terms of a fixed dollar amount or percentage as an appropriate award can be easily calculated by making reference to the standard retirement variables.

Points accrued during marriagetotal points earned during reserves multiplied by 50 to get percentage of retirement pay. This act comes into play in a divorce in which one or both parties have military retirement accounts. For example the order could state. The new military pension division rule is a rewrite of the terms for military pension division found in the Uniformed Services Former Spouses Protection Act or USFSPA1 This revision requires that the military retired pay to be divided will be that attributable to the rank and years of service of the military member as of the date of divorce.

That produces the marital fraction or the percentage of the military members retired pay that was earned during the marriage. There is a federal code that relates to the retirement funds of military personnel called the Uniform Services Former Spouses Protection Act USFSPA. Military Retirement Division in Florida Military Divorce. For members qualifying for an active duty ie regular service retirement.

Instead of allowing the states to decide how to divide military retired pay and what formula or methodology to use Congress imposed a single uniform method of pension division on all the states a hypothetical scenario in which the military member retires on the day that the pension division order is filed. This is so even though the member. Remember a military retirement is asset division not income division. Use the active duty formula but instead of using length of marriage during servicetotal time in active duty the formula would use.

Division of Retired Pay by Fixed Dollar Amount or Percentage. The act gives the ex-spouse the right to include the retirement account as marital. For example a former spouse can only receive. Wife shall receive 37 of the Husbands disposable retired pay times a fraction the numerator being the months of marital pension service and the denominator being the total months of service by Husband The court must.

Former Spouse Benefit ½ x marital asset assuming equal division The time rule formula determined a former spouses benefit based on the service members retired pay at retirement8Thus under this for- mula the former spouse received the benefits of the military members rank and time-in-service pay increases that occurred after the divorce9. This is divided by the total number of months or years of the members creditable military service.