Military Retirement Calculation Formula

If you're searching for picture and video information related to the keyword you've come to visit the ideal site. Our site gives you suggestions for seeing the highest quality video and image content, hunt and find more informative video articles and graphics that fit your interests.

comprises one of tens of thousands of movie collections from several sources, particularly Youtube, therefore we recommend this movie that you see. This blog is for them to visit this site.

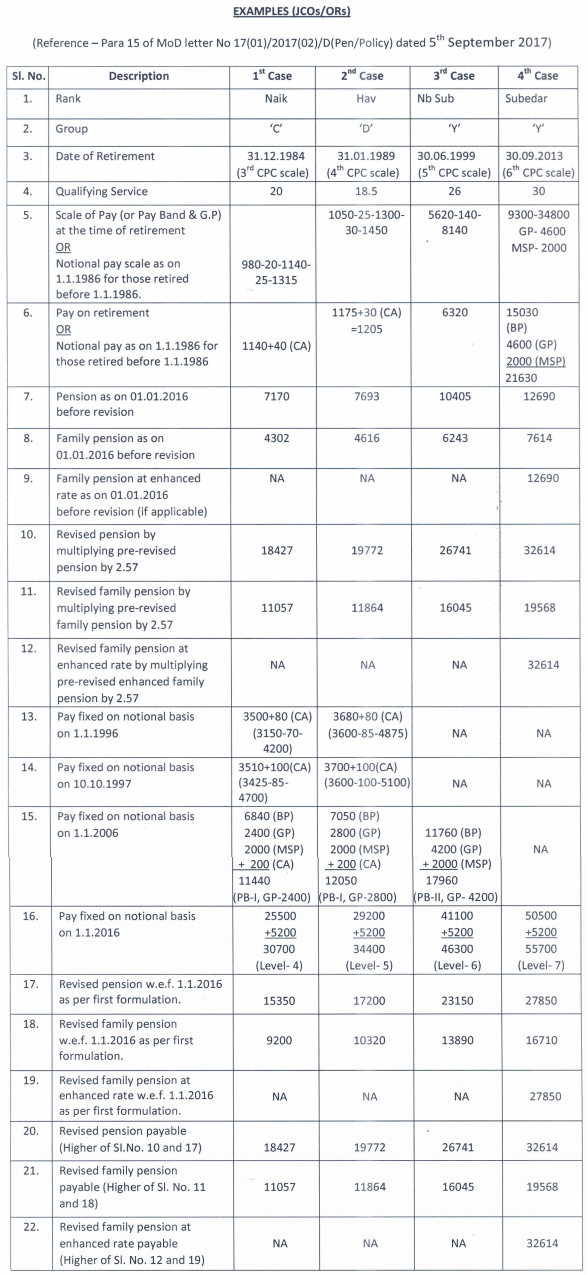

After youve served 20 years in the military youre eligible for retirement benefits.

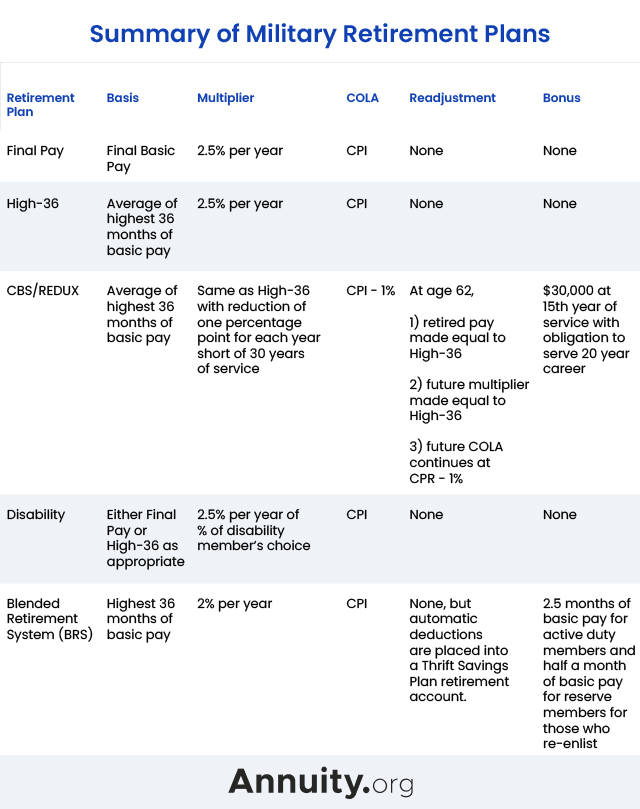

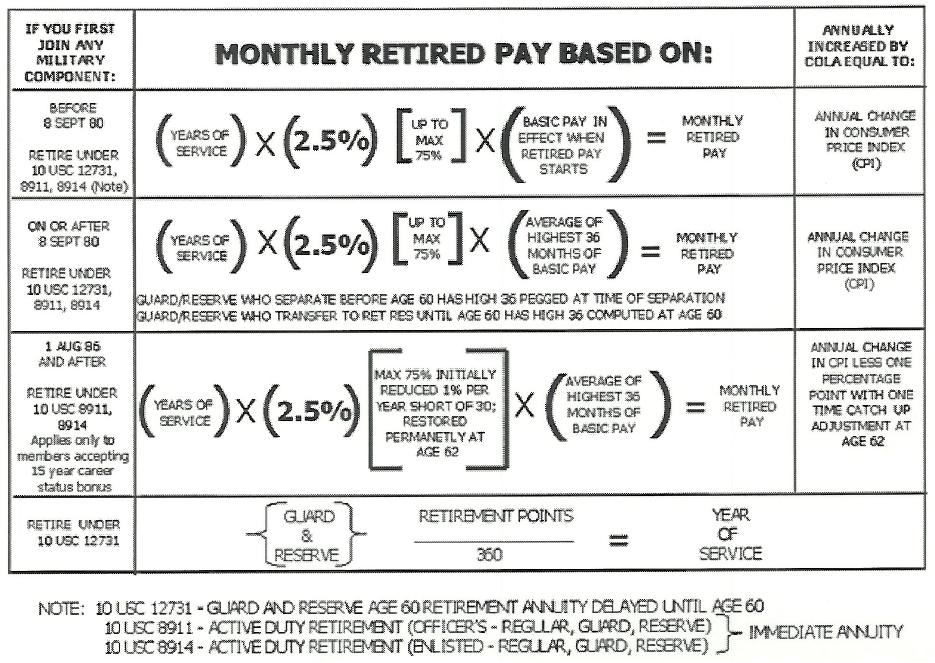

Military retirement calculation formula. Automatically calculates for High-3 or Final Pay depending on the date entered service - High-3 is for those. 25 x Years of Service x High 3 Pay Avg highest 36 months of basic pay. The most Sam can be awarded by the divorce court from Pats military retired pay is 50 of the calculated disposable retirement for a Captain with 8 years of service. Of all the retirement plans the Final Pay system uses the simplest formula.

For example if you retire after 40 years of active service then you can expect to receive 100 of your monthly base pay as your retirement pension. Pay base is different from base pay. The idea of an area multipling two numbers toegher works because a product of two variables is how a military monthly retirement check is calculated plus an extra 25 factor and any conversion factor between points months years and days. 8 1980 the base pay used to calculate your retirement is the base pay at the highest pay grade at which you served.

Future pay is. Basic Pay Special and Incentive Pays Allowances Tax Information Recoupment Retirement Calculators. All others use the total of their basic pay from the highest 36 months during their time of service to determine their base pay for retirement purposes. Marital Asset 502725 x 48 marital duty months240 total duty months Marital Asset 100545 Former Spouse Benefit 50272 assuming equal division Under the NDAA the spousal benefit changes dramatically.

Pension service multiple x pay base. At the time of the divorce we can not calculate the spouses percentage of military retirement because the denominator or years of service is still growing. Your total monthly allotment is based on several factors which includes annual cost of living adjustments. EXPLANATION OF THIS CALCULATION.

Military pension is similar to other kinds of retirement pay but more complicated. So 25 or 025 multiplied by the total time years months the service member has been active duty enables you to calculate the total allotment the service member has gained upon retirement. The amount generally is based on your length of service or your disability percentage. Factors such as the year you entered service and your retirement type also affect your pay.

In this case the numerator is 18 years or 216 months. Youll receive 25 of your final monthly basic pay for every year of service. Coefficient of Pay as per age x Number of years of service with the organization In the case of an employee who is under 22 years of age she is entitled to 05 weeks wages. Monthly retirement 25 base pay service credit in years.

If you entered military service before Sept. The numerator can be determined though by the length of the marriage. To award the spouse 50 of the military retired pay the court order would read as follows. This is computed by using the following formula.

Those having joined the military after September 8 1980 have a retirement pay that is reduced under High 36. Instead of referring him to one of the many Military Retirement Calculators online Doug dedicated the time to write a very detailed post to educate any of our readers looking for assistance with the. BRS Comparison Calculator BRS Calculator High-3 Calculator Final-Pay Calculator REDUX Calculator RMC Calculator SCAADL Calculator Benefits. IF a service member retires at 20 years the military member earns 25 of their income towards retirement each year.

The formula for finding retirement pay is. The military retirement has long been based upon the following formula. Death Gratuity New Retired Benefits Program Office of the Actuary. Military Retirement Calculator - Compare military retirement pay against different retirement dates and ranks estimate future pay for 40 years after retirement and automatically calculates early retirement pay if you enter a retirement date that is less than 20 years of service.

Depending on when you entered the service you may have the option of getting a bonus contributing to the Thrift Savings. Final Pay Calculator - This calculator estimates your retirement benefits under the Final Pay retirement plan for those members who first joined prior to September 8 1980. The sender was seeking a Reserve Retirement Calculator specifically for the National Guard or Reserve. When Pat eventually retires as a full Bird Colonel the portion of the pension representing the service and rank beyond an 8-year Captain will be Pats sole.

Military Retirement Calculator - Compare military retirement pay against different retirement dates and ranks estimate future pay for 40 years after retirement and automatically calculates early retirement pay if you enter a retirement date that is less than 20 years of service. Service multiple comes from the number of years of service or Reserve drill points two different formulas. Approximately 998 accurate for final military retirement pay. In the case of an employee who is between 22 and 41 years of age she is entitled to one weeks wages.

Sam may also get Cost of Living Adjustments COLA for their portion. The military retirement can be very confusing to understand and calculate. Military Retirement Calculators The Department of Defense uses a multi-step formula to compute your retired pay. Under the time rule formula the calculation of the former spouses benefit is.

In this case the hypothetical says the service. The military retirement pension formula is.