Military Pension Divorce Calculator Uk

If you're looking for picture and video information related to the key word you have come to pay a visit to the ideal blog. Our site gives you suggestions for seeing the highest quality video and picture content, hunt and locate more enlightening video content and images that match your interests.

comprises one of thousands of movie collections from various sources, particularly Youtube, so we recommend this video for you to view. This site is for them to visit this site.

It is absolutely vital that you take legal advice at an early stage if you are considering a divorce and you are a military pension holder or are married to one.

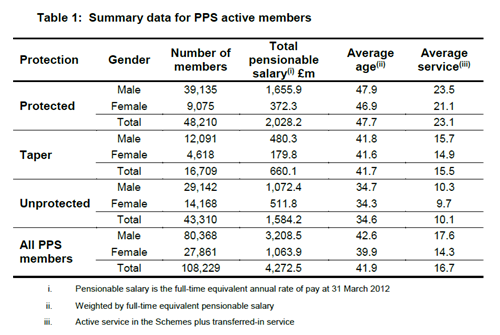

Military pension divorce calculator uk. Pensions are defined benefit plans. The first thing that must be established is whether the retirement plan is a defined benefit or a defined contribution plan. In order to ascertain a true value of your financial and property assets which will be taken into consideration during your divorce proceedings you will need to obtain a Cash Equivalent Value CEV of your pension. What are the first steps in calculating the value of a pension in a divorce.

Either a pension sharing order by offsetting the value of the pension against other assets or using a Pension Attachment order. Review the documentation the library articles and the links to government and authoritative websites to find the expert advice you need. If your spouse works for the military police NHS fire service or has a teachers or local authority pension then it may be worth asking the court to consider a Transfer Value Comparison rather than a standard CETV. There are many different types of pensions and one of the most challenging and interesting types to deal with are military pensions army naval royal air force.

Solicitors warns about the treatment of pensions following a divorce. In England Wales or Northern Ireland the total value of the pension benefits you have each built up at the date of the divorce or dissolution of the civil partnership is taken into account. Obtain State pension forecast from the. Try our Pension Divorce Calculator to see what you might be entitled to in a Divorce.

Mark items to do. The marital share amount of your military pension is determined by adding up the number of months you were married and serving in the military then dividing this number by the total time you served in the military before separation. In any divorce involving services personnel it is often the case that the most valuable asset in a marriage is the terminal grant and pension says Bryan. Sam may also get Cost of Living Adjustments COLA for their portion.

The Pension Calculator is for guidance purposes only. Using the Divorce and money calculator. It is not intended to provide you with financial advice. If military personnel decide to divorce how that pension is divided will be determined by a civilian court using rules devised specifically for Armed Forces personnelThe serving member may have their pension rights calculated and considered as part of the familys overall financial assets when division of property.

Divorce Dissolution request. A military pension is very different to a state public sector teacher NHS or civil service or private occupational pension. This section provides an overview of sources of information for both military and state pensions. In this case the numerator is 18 years or 216 months.

To find out more read this guide to what happens to a pension during divorce written by our specialist advisers. Download the Divorce and money calculator spreadsheet. This blog only touches the surface of this area but hopefully will give guidance on things to think about when dividing a military pension on divorce. Armed Forces Pension Scheme.

The CEV will depend on which military pension you. Adjustment for Market Conditions is no longer used and has been removed from the table. You may be eligible for an armed forces pension if youre a current or former member of the armed forces. Once this is determined then a valuation date must be established.

The calculator also includes details on where to seek professional help should you need it. The most Sam can be awarded by the divorce court from Pats military retired pay is 50 of the calculated disposable retirement for a Captain with 8 years of service. The pension schemes provided by the Armed Forces have recently been changed. Tables of factors Table A1.

If youre thinking about getting divorced or dissolving a civil partnership this calculator can give you an idea of. The numerator can be determined though by the length of the marriage. Find out how to manage your money and think about finances when going through divorce. Create your personalised to do list by selecting the items appropriate to you from the list below.

The value of a defined contribution plan is simply the account balance as of a given date. If you want an assessment of pension or cash equivalent valuation for a divorce or dissolution of civil partnership please complete and return this form by post. This is all of your pensions whether you built them up before or during your marriagecivil partnership. Your solicitor will be able to advise you on the pension sharing procedure and may instruct an actuary pensions expert on your behalf who will be able to accurate calculate how much of the pension is shareable so you are able to.

At the time of the divorce we can not calculate the spouses percentage of military retirement because the denominator or years of service is still growing. This blog is one of three. Pensions can be split in one of three ways during a divorce. Use the calculator to work out how.

If youre currently serving in the armed forces. Pension Sharing on Divorce ARMED FORCES PENSION SCHEME PENSION SHARING ON DIVORCE Factors for Divorce Calculations Published Apr 2019 The effective date for all factors is 29102018 other than M1M2N1N2 which are effective from 01042019.