Military Pension Calculator Canada

If you're searching for picture and video information linked to the key word you've come to visit the ideal blog. Our site gives you hints for viewing the maximum quality video and picture content, hunt and find more enlightening video content and images that match your interests.

comprises one of tens of thousands of movie collections from various sources, particularly Youtube, therefore we recommend this video for you to see. You can also contribute to supporting this website by sharing videos and images that you enjoy on this blog on your social networking accounts like Facebook and Instagram or tell your closest friends share your experiences about the simplicity of access to downloads and the information you get on this site. This blog is for them to stop by this website.

More importantly when you look at post-military careers you need to take into account that these were tax-free allowances and that you will need more before-tax.

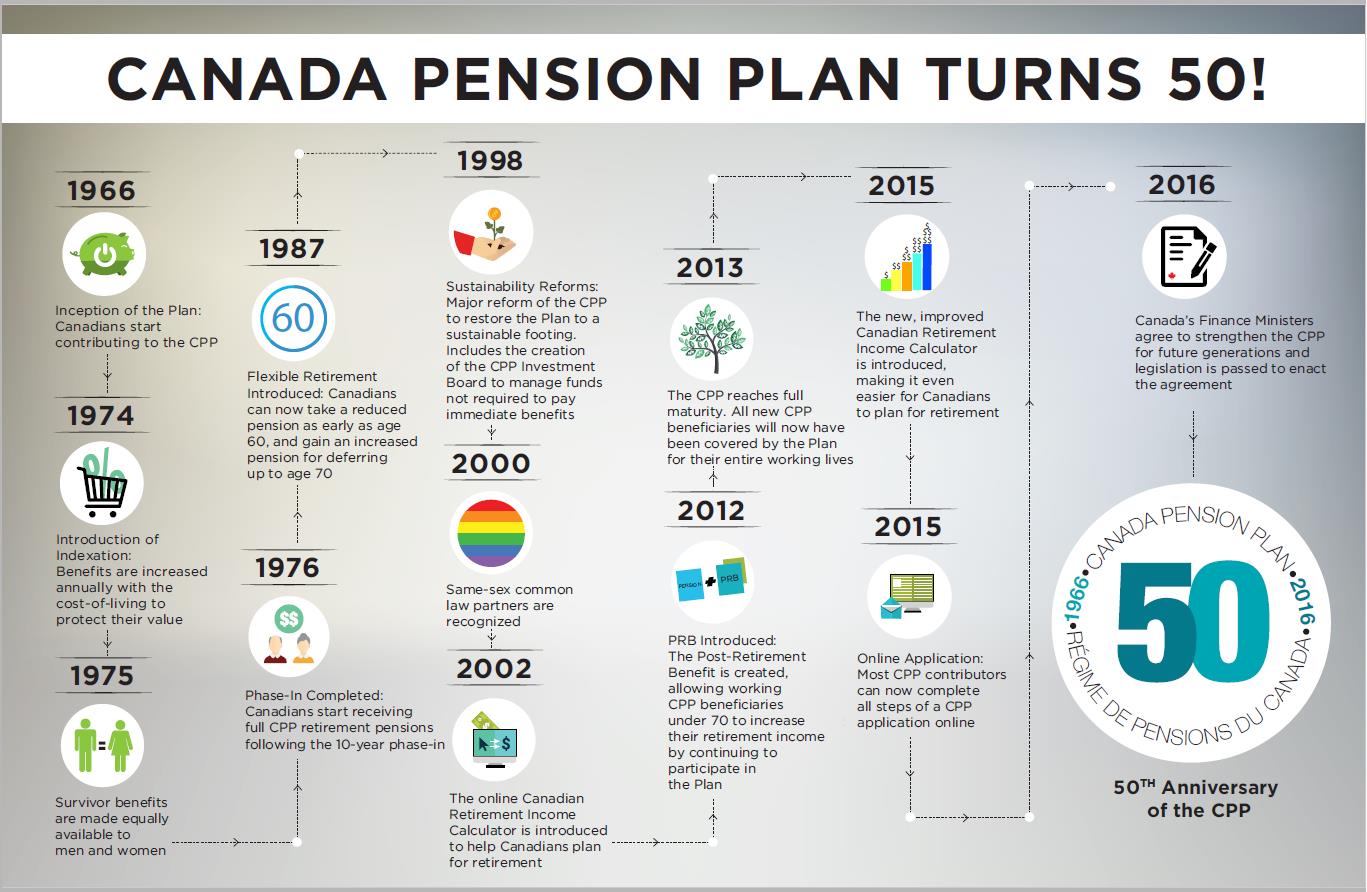

Military pension calculator canada. It is not intended to provide you with financial advice. CPPQPP is based on how much and for how long you contributed to the plan and the age at which you choose to start your CanadaQuebec pension payments. Service members who entered the armed forces before Sept. Although PSPC will administer the CAF pension plans from the new Government of Canada Pension Centre satellite office in Ottawa the Minister of National Defence will continue to be responsible for the Canadian Forces Superannuation Act and.

Instructions to access the web application. Many people dont consider the fact that you will no longer get housing allowance subsistence allowance or COLAs. This calculator provides a comparison between the Legacy High-3 vs. It is important to contact the.

Services and benefits for the military. Critical Pension Services Maintained. If youre currently serving in the armed forces Use the calculator to work out how much. This calculator is designed to be used by Regular Service MPGS and Reservist personnel including those with Transitional Protection.

BRS CalculatorThis calculator estimates your. On July 4 2016 the administration of the Canadian Armed Forces CAF pension plans was transitioned to Public Services and Procurement Canada PSPC. Welcome to the Armed Forces Pension Calculator. His annual income limit is 13931.

Military Retirement Compensation Calculators. The Armed Forces Pension AFPC includes a projection of benefits from the Armed Forces Pension Schemes. RMC Calculator - RMC represents a basic level of compensation which every service member receives directly or indirectly in-cash or in-kind and which is common to all military personnel based on. Automatically calculates for High-3 or Final Pay depending on the date entered service - High-3 is for those.

Learn about participating in the pension plan retirement income sources and pension options. The Blended Retirement System BRS. Military pay pension and benefits. Military retirement calculators for retirement pay BRS High-3 Redux COLA Thrift Savings Plan by service comparison calculators and much more.

Our retirement calculator takes into account the average Canadian retirement income from the Old Age Security OAS and Canada Pension Plan CPP for 2018. Sign in to Your Public Service Pension Plan web application CWA available on the Government of Canada network only Access your pension plan information Pension and Insurance Benefits Statement PIBS pension benefits calculator and tools to estimate service buyback and survivor benefits. Find information about the Canadian Armed Forces Pension plans that is specific to you as an active or retired member and to your survivorschildren. Joe a single veteran has an annual income of 5000.

Canadian Armed Forces pensions are administered by the Government of Canada Pension Centre at the Public Services and Procurement Canada Pension Centre. Blended Retirement Comparison Calculator. To determine Joes pension subtract his annual income of 5000 from the 13931 income limit which gives. This is a type of defined benefit pension scheme offered by employers.

You may be eligible for an armed forces pension if youre a current or former member of the armed forces. This scheme was based on the AFPS 75 principles. Should you choose to start your CanadaQuebec pension payments earlier than age 65 your monthly CPP payment will be reduced by 06 per month for every month before 65. Full Time Reservists also had a separate pension scheme FTRS 97 open to them between April 1997 and April 2006.

This calculator is designed to be used by Regular Service MPGS and Reservist personnel including those with Transitional Protection. 8 1980 and are still serving can use the Final Pay Calculator to estimate their future military pension amount. Before we discuss your military pension lets make sure to clarify what your post-military pay looks like. Military Retirement Calculator - Compare military retirement pay against different retirement dates and ranks estimate future pay for 40 years after retirement and automatically calculates early retirement pay if you enter a retirement date that is less than 20 years of service.

Youll need to input how much you extra you expect to get in the retirement income field otherwise well assume average numbers. Of all the retirement plans the Final Pay system uses the simplest formula. Youll receive 25 of your final monthly basic pay for every year of service. This will include income from defined benefit and defined contribution schemes plus.

Military pensions Expand all. When a member of the armed forces reaches their retirement age they receive one of the most generous pensions available in the UK. The Pension Calculator is for guidance purposes only. The current AFPS 15 pension scheme is a career average revalued earnings CARE scheme.

In a few easy steps our pension calculator can give you an estimate of the income youll get when you retire. Canadian Armed Forces pensions.