How To Create A Budget For The Next Fiscal Year

If you're looking for video and picture information linked to the keyword you have come to pay a visit to the right blog. Our site gives you suggestions for viewing the maximum quality video and picture content, search and locate more informative video articles and images that match your interests.

comprises one of tens of thousands of movie collections from various sources, particularly Youtube, therefore we recommend this movie that you see. This site is for them to visit this website.

Then you need to add the amount from the events list.

How to create a budget for the next fiscal year. Clients would know their entire budget for the next year and give agencies the opportunity to plan a full years worth of media at once. Enabling you to make confident decisions to meet your objectives. The federal governments fiscal year runs from October 1 to September 30. An operating budget consists of revenues and expenses over a period of time typically a quarter or a year which a company uses to plan its operations.

The budget planning process the yearly exercise where business units submit their numbers to the CFO to establish next years budget has become a routine function within many organizations. A balanced budget means your revenues are equal to your expenses. Add together last years expenses plus 10 percent for the operating costs for each month. Businesses often use the calendar year -- January 1 to December 31.

Many organizations prepare budgets that they use as a method of comparison when evaluating their actual results over the next year. The budgeting process for most large companies usually begins four to six months before the start of the financial year while some may take an entire fiscal year Fiscal Year FY A fiscal year FY is a 12-month or 52-week period of time used by governments and businesses for accounting purposes to formulate annual to complete. Creating the Budget Document 13. Review any documentation you can use to support your budget numbers.

We dont have a single client that operates. Ensuring you can continue funding your current commitment. For example assume your business is planning for next year. You may want to set up a slush fund that you contribute to each month to cover these types of expenses.

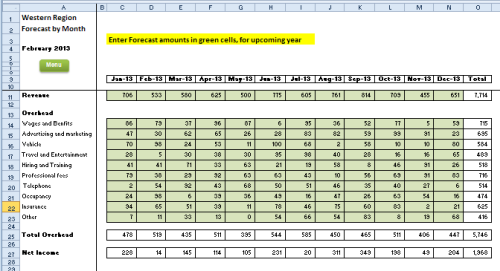

The monthly budgeting template has a column for each month and totals to be the full year annual figures. Open a new budget and configure dates Click Budgets New Budget. If that is the case you will want to label. Creating a one-year budget or any budget for that matter is a lot easier if youve already written down how much income you make from all sources your recurring monthly expenses including all debts and any irregular expenses.

Being able to project forward fluctuations and stay within the constraints of a budget sets the expectations for the year. This will give you the knowledge to start using current actuals to project forward along with new plans for the next year. Update budget assumptions. Use an Organized Format.

To create a relevant and useful budget it must be tailored to the needs of your organization. Here are the basic steps to follow when preparing a budget. Owners and managers can be held responsible for the activities within their control. The process of preparing a budget should be highly regimented and follow a set schedule so that the completed budget is ready for use by the beginning of the next fiscal year.

Companies typically rely on current year actual performance to start building assumptions for the next fiscal year but COVID-19 has compromised that capability. Creating a budget for the new year encourages accountability. Nothing should be carried over from the previous year to make this years budget balance UNLESS it is a contribution or donation that was restricted in the previous fiscal year and its restrictions are intended to be satisfied in this budgeted fiscal year. Your school budget should reflect your school improvement plan set on a five-year basis showing two years in retrospect the current year and the next two years forecast.

If so figure up the annual cost and divide it by 12 for your monthly budget. So lets talk about irregular income and expenses. The economy which the International Monetary Fund singled out as a global bright spot only a few years ago is set to contract 77 per cent in this fiscal year to March 31 the deepest. Set the fiscal year for the budget then choose either Profit and Loss and Balance Sheet.

Fiscal year simply means financial year and is the calendar you use to figure your yearly budget and which determines when you file tax forms get audited and close your books. Download the Free Excel Template. You cannot directly modify the start date of the new budget because it must occur immediately after the previous budget. Thus you can assign some restricted funds to proper.

Go to the Company menu and hover over Planning Budgeting. When you do settle on your numbers for next year enter them into a copy of yourincome balance and cash flow statementsBe sure to add another column that calculates the difference between the twovalues indicating an increase or decrease in the revenue or expenseFor example Ive taken the balance statement that I created earlierAnd I have added a Projected column for fiscal year 2011 and a Change column. There are many different fiscal years you can use. Then select Set Up Budgets.

If you select Profit and Loss you can add additional. A budget will outline your estimated revenues and then include a plan for expenses that is less than those revenues so that you can earn a profit. You can create next years budget from scratch or use last years Profit and Loss data to start one. Regardless of your numbers you need to select a useful format to organize them.

This creates a new budget whose start date is the day after the end date for the previous budget. An income statement balance sheet debt tax returns and projections will help with estimates. A surplus means your revenues exceed expenses and a deficit means expenses exceed revenues. Moreover the typical approach of validating budget assumptions by using external sources market data and macroeconomic outlooks are currently less helpful due to the unique ways in which the pandemic has impacted each company and.

As a business your budget. A spreadsheet is the best option here. Set a list of funding sources on the top edge and the expense categories on the left-hand edge. If you need detailed information then you need a detailed account structure.

Because were budgeting for an entire year at once youll need to look past just your income and expenses. Select Create New Budget. This allowed for great negotiating power but stagnant buys. Good agencies would shift the plan based on opportunity throughout the year bad agencies would sit back and just let it run.

Most organizations set budgets and undertake variance analysis on.