How Much Does It Cost To Buy Back Military Time For Federal Retirement

If you're looking for video and picture information linked to the keyword you've come to pay a visit to the right blog. Our site provides you with suggestions for viewing the maximum quality video and image content, hunt and find more enlightening video content and images that match your interests.

includes one of thousands of video collections from several sources, particularly Youtube, therefore we recommend this movie that you view. It is also possible to bring about supporting this site by sharing videos and graphics that you like on this site on your social networking accounts such as Facebook and Instagram or educate your closest friends share your experiences about the simplicity of access to downloads and the information you get on this site. This site is for them to stop by this website.

In my case the cost was.

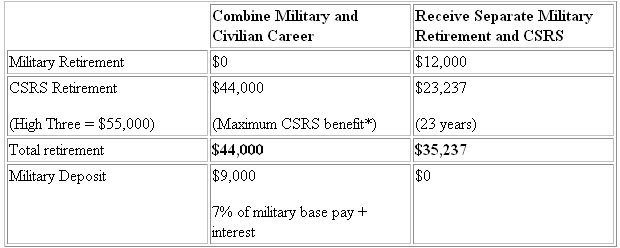

How much does it cost to buy back military time for federal retirement. Except for the period of 1999-2000 which has a slightly higher buy back rate. My concern is that the active-duty time that would normally translate into points. They must buy back their military service time to have it added to their civil service time 3 for FERS and 7 for CSRS of base pay. Your buy-back time will increase the number of years used for your annuity calculation.

You are applying to buy back your military service time within three years of civilian service and therefore no interest will be charged. You can make a deposit for creditable Federal Employees Retirement System FERS service you performed before 1989 during which retirement deductions were not withheld from your pay. 110000 x 30 x 1 33000 or 2750 Per Month That is an extra 550month or 6600 per year but the true difference is apparent when we look at the change over an entire retirement. Feds Buying Back Their Time in Military Service Approximately one-third of all civilian federal employees have previously served in the Armed Forces.

That time at an Academy can be bought for retirement time even if you are getting an active duty retirement since the time spent at an Academy is not counted as part of the military service retirement. For FERS employees the deposit is 3 of basic military pay. The amount that you were paid during your military service. And if he chooses to leave a survivor annuity to his wife her survivor annuity will be based on Bobs higher amount.

It can also be bought along with ones active duty years if you are not drawing a military retirement. But if they make the decision to buy back their military time of 5 years of honorable service theyre estimated pension will be 2085 per month an increase of 297 per month. All FERS employees and CSRS employees that anticipate having at least 40 quarters 10 years of work under social security at age 62 should consider paying back their military time. In the example given the cost of buying back military time would be recouped in just 8 months.

The deposit amount is generally 13 of salary plus interest. Ive contacted my HR and havent gotten a definitive answer that proves that I can buy back my active duty military time and put it toward my Federal Retirement and then go into the Reserves and have that Active Duty time still count toward the time-in-service AND also the pointsgood years needed to retire. There is only one exception to this rule. The bottom line is as Reg says you have to run the numbers to know for your exact circumstance.

In the situation mentioned above if you purchased back 4 years of military time you would be able to retire at age 63 with 9 years towards retirement. If you have prior military service and you didnt serve long enough to qualify for a military pension you can buy back that military service time and have it added on to your civil service retirement credits thus increasing the payout for your civil service retirement. By buying back his military time and adding three years to his creditable service Bob will receive an extra 3000 a year in his FERS pension for the rest of his life. The amount that you will need to pay in order to buy back your military time will depend upon several different criteria.

In accordance with Public Law 97-253 employees covered under the Federal Employees Retirement System FERS will receive credit for their Post-56 military service if a deposit is made under FERS. If you decide to buy back your military service time you will have to write the government a check for 3 of the base military pay you earned while you were in the military or have the amount withheld from your future paychecks. Otherwise your annuity will decrease. Many of these feds have heard of a buy back option that allows them to have their time in active-duty count towards retirement eligibility and pension benefits in the civil service but most Toggle navigation 877 741-1254 Mon-Fri 8am.

I bought back my 3 plus years of active duty military time when I discovered that my CSRS retirement annuity would decease at age 62 if I didnt. If you have performed honorable active military service after December 31 1956 and have now accepted a position within the federal government your active duty time will count toward your federal retirement pension. Youll still receive all the other military benefits to which youre entitled if you buy back your service time. If we factor in the assumption of living to the age of 90 that adds an additional 99972 to their total lifetime pension earnings.

The Cost of Not Buying Back Military Time Over Time excluding COLA using the example given 10 Years. When your military service took place. The reason for this is the relative cost of buying back military time that was spent being paid as an E1-E6 is relatively small compared to how those years get multiplied through a FERS retirement using a much higher pay gradepay. For federal employees with more than three years of civilian employment prior to application to buy back their military service time there may be interest charges.

CSRS Employees First employed before 10011982 If you are eligible for Social Security Benefits at retirement or at age 62 and. Interest is charged from the midpoint of periods of service and is compounded annually. As an example if you attended a United States Service Academy for four years graduated and then served five years in the military honorably those nine years will count toward. However it does not count toward the minimum time needed for retirement.

In other words if you hire into the federal service at say age 58 you must work at least 5 years to be eligible to collect an annuity not counting buyback time. Thus an Academy grad who left active duty after six years could buy ten years towards a.