How Is Military Retirement Cola Calculated

If you're searching for video and picture information related to the key word you have come to visit the right site. Our site provides you with suggestions for seeing the highest quality video and image content, hunt and locate more informative video articles and images that match your interests.

comprises one of tens of thousands of movie collections from various sources, particularly Youtube, therefore we recommend this video for you to view. This blog is for them to visit this website.

Retirees who entered military service on or after Aug.

How is military retirement cola calculated. Military Retirement Pay Computation For members who entered active duty or on prior to September 8 1980 retired pay amounts are determined by multiplying your service factor normally referred to as your multiplier by your active duty base pay at the time of retirement. And the result was produced. Calculating military retirement pay starts with your basic pay which is the monthly salary on active duty. The first COLA after starting a military pension is generally pro-rated by the quarter of the year in which the retirement occurred.

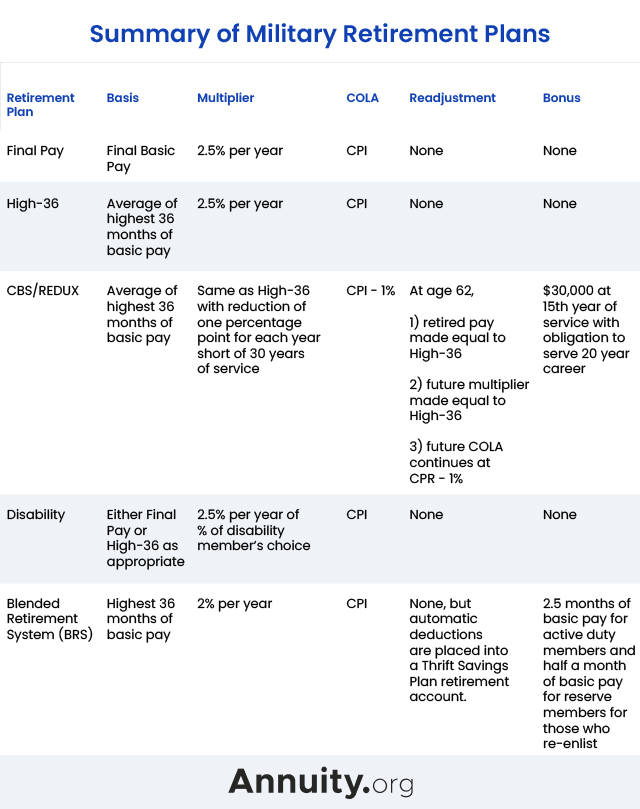

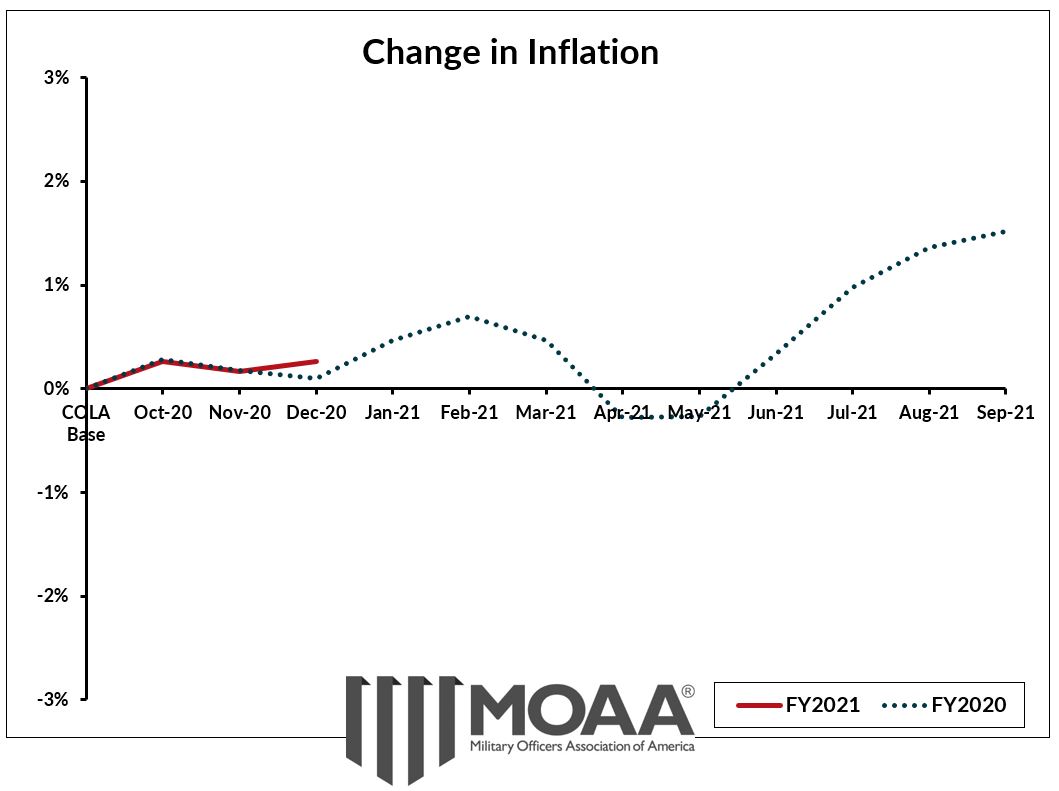

The COLA is determined by the percentage increase if any. The retired pay computed under each retired pay plan is adjusted each year effective December 1st by the change in consumer prices. 8 1980 and are still serving can use the Final Pay Calculator to estimate their future military pension amount. It is based on the percentage increase of the CPI-W from the 3rd quarter of the previous year versus the current years 3rd quarter July August and September.

If you first entered military service on or before September 8 1980 your final basic pay is multiplied by a percentage called a multiplier to determine retirement pay. Calculator to compare COLA cost of living adjustment pension payouts to a fixed pension with a higher initial monthly payment this determines the breakpoint where you outlive the pension enough for the COLA pension to provide more income than the fixed counterpart. COLA is pegged to the Consumer Price Index CPI which is a formula calculated by the Bureau of Labor Statistics. The specific COLA wording is in federal law Title 10 US.

Increases to the pay table itself by law are tied to the Employment Cost Index ECI from the Bureau of Labor Statistics. Service members who entered the armed forces before Sept. Projections are based on current retirement plans average military pay increases and average COLA rates. Our 2020 Estate Plan Saga Federal FERS Retirement w SRS 2017 Tax Bill Deductibility Taxable Social Security Benefits.

As we learned in the run up to the retirement reform process in 20142015 it is not so much what you may value your military retirement it is what the DOD the actuaries from Treasury and a host of others at the time did. As retirement plans are affected by policy and congress I will update my formulas accordingly. Cola 2021 Increase For Retirees A military member that serves on basic duty and also active duty is qualified to get an allowance services and also advantages as set up by law. This calculator provides a comparison between the Legacy High-3 vs.

My calculator calculates retirement pay and historic military retirement pay even if you retired back in the 1960s. Blended Retirement Comparison Calculator. COLA is determined by increases in the Consumer Price Index for Urban Wage Earners and Clerical Workers CPI-W. Its hard to parse the verbiage but for High Three no CSB or REDUX its.

How COLA is Determined The Cost-of-Living-Adjustment aka Cost-of-Living Allowance is determined by the Bureau of Labor Statistics Consumer Price Index CPI-W. The old adage does apply money in the bank is at times the best defense against a rainy day. COLA All military retirements are protected from inflation by an annual Cost of Living Adjustment COLA based on changes in the Consumer Price Index CPI as measured by the Department of Labor. The first COLA adjustment after retirement is calculated under a formula different than that above if the member retires between January 1st and September 31st.

Automatically calculates for High-3 or Final Pay depending on the date entered service - High-3 is for those. CPI-W is calculated on a monthly basis by the Bureau of Labor Statistics. The final measurement is used for many government calculations such as the Cost of Living Adjustment for federal pension plans including FERS and CSRS pensions and military retirement pay as well. This is to preclude the advantage.

Military Retirement Calculator - Compare military retirement pay against different retirement dates and ranks estimate future pay for 40 years after retirement and automatically calculates early retirement pay if you enter a retirement date that is less than 20 years of service. In laymans terms it tracks inflation for the cost of certain consumer goods. 1 1986 and opted for the Career Status Bonus CSBRedux retirement plan have any COLA increases reduced by 1 so they will see a smaller. Military Retirement Compensation Calculators.

HOW TO CALCULATE YOUR MILITARY RETIREMENT PAY For military service members who began active duty service on or prior to 8 September 1980 your military retirement pay is calculated by multiplying your service factor or multiplier by your active duty base pay at the time of your retirement. For all retirees regardless of retirement plan the Military Pay Table in place on the retirement effective date serves as the basis on which their retirement is calculated. Active duty Army Marine Corps Navy and Air Force military final retirement. Code section 1401a d.

The Blended Retirement System BRS. Having a constant paycheck with a bonus offer that without tax is just one of the largest advantages of functioning within the military. Military retirement calculators for retirement pay BRS High-3 Redux COLA Thrift Savings Plan by service comparison calculators and much more. Youll receive 25 of your final monthly basic pay for every year of service.