How Is Military Medical Retirement Calculated

If you're searching for video and picture information related to the keyword you have come to pay a visit to the ideal site. Our website provides you with hints for viewing the maximum quality video and picture content, hunt and locate more enlightening video articles and graphics that match your interests.

includes one of tens of thousands of movie collections from several sources, particularly Youtube, so we recommend this movie for you to see. This blog is for them to stop by this website.

Automatically calculates for High-3 or Final Pay depending on the date entered service - High-3 is for those who.

How is military medical retirement calculated. The Department of Defense uses a multi-step formula to compute your retired pay. However your condition will have to qualify. When measuring retirement pay only basic pay militates which is received by all members of the military. Military Retirement Calculator - Compare military retirement pay against different retirement dates and ranks estimate future pay for 40 years after retirement and automatically calculates early retirement pay if you enter a retirement date that is less than 20 years of service.

Of all the retirement plans the Final Pay system uses the simplest formula. You normally have to wait until youre at least 55 before you can start getting your pension. Factors such as the year you entered service and your retirement type also affect your pay. Permanent disability retirement occurs if the member is found unfit the disability is determined permanent and stable and rated at a minimum of 30 or the member has 20 years of military service For Reserve Component members this means at least 7200 retirement points.

Step 2 Subtract the Current Baseline Offset. Regular Military Compensation RMC represents a basic level of compensation which every service member receives directly or indirectly in-cash or in-kind and which is common to all military personnel based on their pay grade years of service and family size. The basic retirement formula is. Youll receive 25 of your final monthly basic pay for every year of service.

Monthly basic pay is calculated by an individuals rank and years served. You may have received a statement of your military retirement benefits that either provides your actual benefit or your projected benefit. Calculate how much income youll have if you retire early Your workplace or personal pension. Military medical retirement is intended to compensate for a military career cut short because of disability.

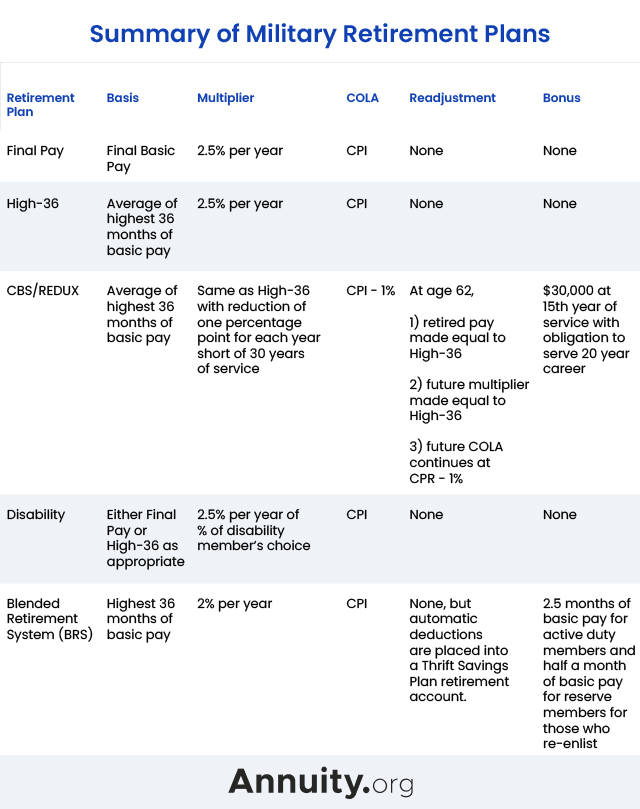

By and large each military retirement calculator will operate on the same basic formula. The amount generally is based on your length of service or your disability percentage. The disability rating percentage or Method A Your years of active service or Method B Those who were transferred from the Temporary list to the Permanent list have their pay recalculated using the most current disability percentage rating. Retired Pay Base X Multiplier The retired pay base for a qualified disability retirement is determined under either the final pay method or the high-36 month.

They may be retired from service. If you are considering medically retiring and have questions about your combined post military income after medical retirement you should check out the DFAS Medical Retired Disability Income. This will be equal to the lesser of your retirement compensation or your. For example after 5 years of service in the military If a military personnel is accepted to the Final Pay Plan he gets paid as if hes one of the highest-retired members of the military.

If a military member is no longer able to perform their duties based on a medical condition. 8 1980 and are still serving can use the Final Pay Calculator to estimate their future military pension amount. Service members who entered the armed forces before Sept. Calculating military retirement pay starts with your basic pay which is the monthly salary on active duty.

The formula used to calculate military retirement pay is. If you first entered military service on or before September 8 1980 your final basic pay is multiplied by a percentage called a multiplier to determine retirement pay. Though in most cases retirement rank is the same as active-duty rank there are exceptions. Each pension scheme has its own definition of ill-health but usually it means you cant.

Typically a medical retirement is issued when a medical condition is severe enough to interfere with the proper performance of your military duties. 2½ times of a multiplier is used to calculate the payment of this type of retired personnel. All military retirements are protected from inflation by an annual Cost of Living Adjustment COLA based on changes in the Consumer Price Index CPI as measured by the Department of Labor. They will then take that number and multiply it by your retired pay base to figure out your pay.

A military medical retirement is ideal since it grants you the benefits of a military retirement even if you havent served the minimum of 20 years. For those on the Permanent list retirement pay is calculated in one of two ways. Otherwise you must calculate your estimated retirement compensation based on the formula listed in your military retirement-plan document. The amount of money you receive due to permanent medical retirement is calculated using the percentage or years of active service whichever number is more beneficial to you.