Does Military Retirement Go Up With Inflation

If you're searching for picture and video information related to the key word you've come to visit the ideal blog. Our site provides you with suggestions for viewing the highest quality video and picture content, search and locate more enlightening video articles and images that fit your interests.

comprises one of thousands of movie collections from various sources, particularly Youtube, therefore we recommend this movie that you view. This site is for them to visit this website.

Military Pension Inflation Protection How and Inflation Indexed Pension Keeps Up with Cost of Living.

Does military retirement go up with inflation. Your COLA pay also adjusts each year but based on a different measure of inflation than what. This type of planning can allow more spending in the go-go years. The COLA is determined by the percentage increase if any. The goal is to find the balance between enjoying life now and holding enough financial reserves to account for.

You need to have a plan for that eventuality. At retirement for the years up to 1997 the government would work out your gross state pension basic pension plus SERPS as if you had not been in a company pension and then they would deduct. Veterans who retire during the current calendar year will receive a temporary partial COLA due to already receiving a military pay raise in January. Military retirement pay is subject to federal income taxes and most states tax military retirement pay.

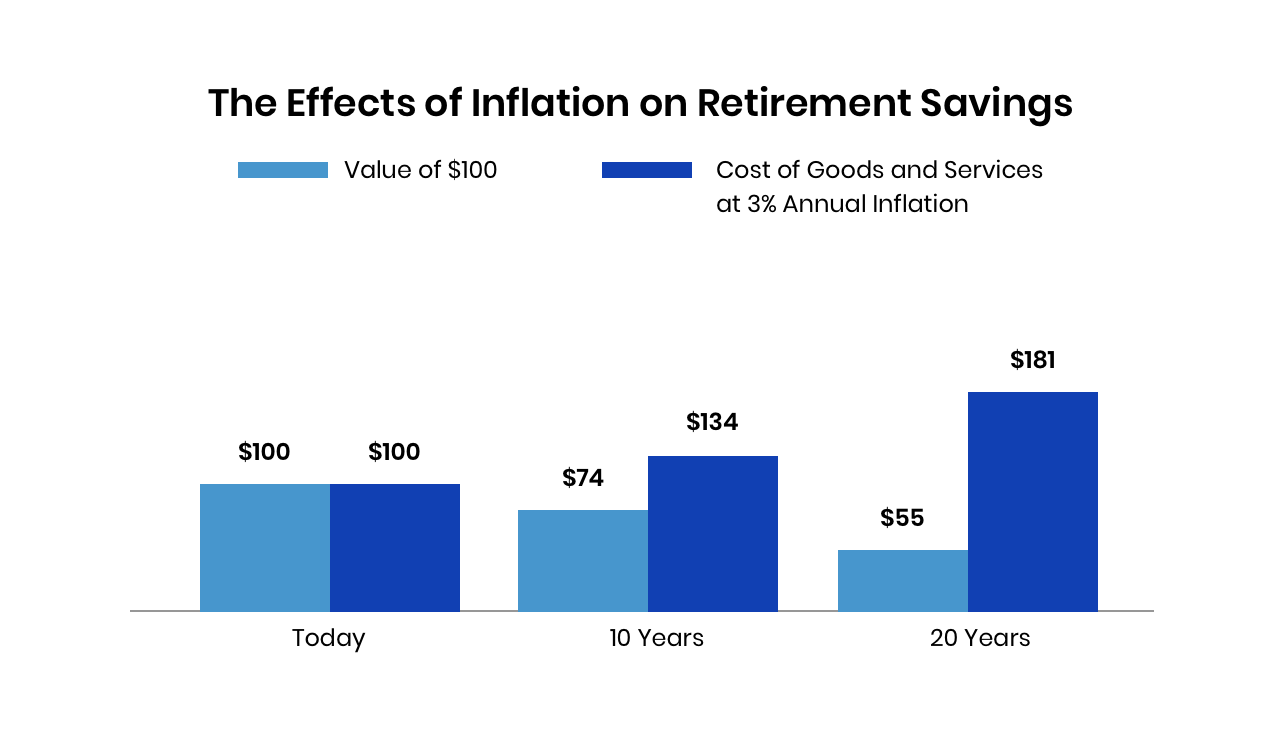

Your retirement plan should include thoughts on how to overcome inflation. Millions of pensioners will receive a pay rise of 25 from April 2021 in line with the triple lock guarantee equating to a boost of up to 22880 for the year. All military retirements are protected from inflation by an annual Cost of Living Adjustment COLA based on changes in the Consumer Price Index CPI as measured by the Department of Labor. After all your expenses are going to go up over the course of 20-50 years of inflation.

One of the best perks of armed forces retirement benefits is that they tie monthly payments to the effects of inflation. What Does This Mean For My Retirement Planning. While this cost-of-living adjustment COLA is automatic by law the percentage varies and often does not keep pace with the rate of inflation. If inflation is over 3 the retirees COLA will trail the CPI by 1.

Then we begin working on a spend-more now plan which may mean less income increases later. The amount adjusts annually based on the consumer price index. 1 1986 and opted for the Career Status Bonus CSBRedux retirement plan have any COLA increases reduced by 1 so they will see a smaller. The retired pay computed under each retired pay plan is adjusted each year effective December 1st by the change in consumer prices.

The 25 rise was confirmed after the Office for National Statistics ONS revealed today that CPI inflation measured 05 in September. Since 83 of servicemembers do not stay in the military for the full 20 years required to get the normal retirement benefit the Commission proposed a new system which includes a defined benefit. Its also adjusted for inflation each year and it lasts for the lifetime of the service member. A world class pension scheme for your military service.

Military Retirees Being Recalled to Active Duty. The COLA increase is only set at the CPI-W if the increase is less than 2 percent. So for 2019 FERS retirees who were entitled to a COLA got 2 not the 28 that the CPI went up. If inflation is between to 2 to 3 percent then COLA is set at 2 percent.

Another significant difference between military retirement and civilian retirement is that a retired military member can be recalled to active dutyThe chances that a military retiree would be recalled to active duty after age 60 or who have been retired for more than five years are slim. If inflation is between 2 and 3 the retiree gets a 2 increase. Military Retirement Pay Increase Every year government benefits like military retirement pay and Social Security increase based on economic inflation. In addition most FERS retirees do not begin earning a COLA until they reach the age of 62.

When a member of the armed forces reaches their retirement age they receive one of the most generous pensions available in the UK. February 12 2019 Leave a Comment Advertiser Disclosure. When you are planning out your retirement you need to take inflation into account. Your retired military pay adjusts somewhat but not to the same rules that apply to active duty raises.

Retirees who entered military service on or after Aug. The buying power of the monthly pension rises along with the cost of living over time. Doug Nordman Last Updated. When projecting retirement success assume expenses will go up by 3 each year in line with historical inflation rates.