Dod Civilian Retirement Pay Calculator

If you're looking for video and picture information linked to the keyword you have come to pay a visit to the ideal blog. Our site provides you with suggestions for viewing the highest quality video and picture content, hunt and locate more enlightening video articles and images that match your interests.

includes one of tens of thousands of movie collections from several sources, particularly Youtube, so we recommend this movie for you to view. This blog is for them to stop by this site.

Factors such as the year you entered service and your retirement type also affect your pay.

Dod civilian retirement pay calculator. Retired military that began civilian service in the OCONUS location without returning CONUS are not entitled retirementseparation PCS. The military disability retirement plan is a defined benefit plan that incorporates basic pay history and either the number of years of service YOS or severity of the disability. Include military time if it is covered. Calculate the premiums for the various combinations of coverage and see how choosing different Options can change the amount of life insurance and the premiums.

Prepare for the changes that will occur due to deployment by using the Deployment Calculator to estimate changes in monthly income and by reviewing related fact sheets. Agile Innovative and Responsive Fueling the Fight. 7 1980 you are eligible for the Final Pay Retirement system. Regular Military Compensation RMC is defined as the sum of basic pay average basic allowance for housing basic allowance for subsistence and the federal income tax advantage that accrues because the allowances are not subject to federal income tax.

The amount generally is based on your length of service or your disability percentage. I am an DoD civilian who was deployed to Iraq in late 2009 thru late 2010. Total number of Years Worked at Projected retirement age. Military compensation calculators active duty retirement.

Percent of salary invested in TSP. If you currently invest a specific dollar amount each pay period follow these steps. Plan for retirement by viewing personalized retirement reports performing what-if exercises to see how your benefits might change and reviewing related fact sheets. The final pay method as the name implies establishes the retired pay base equal to final basic pay.

Buy back military service for civil service retirement credits with a. The Department of Defense uses a multi-step formula to compute your retired pay. Please note State Tax. Social Security Deferral.

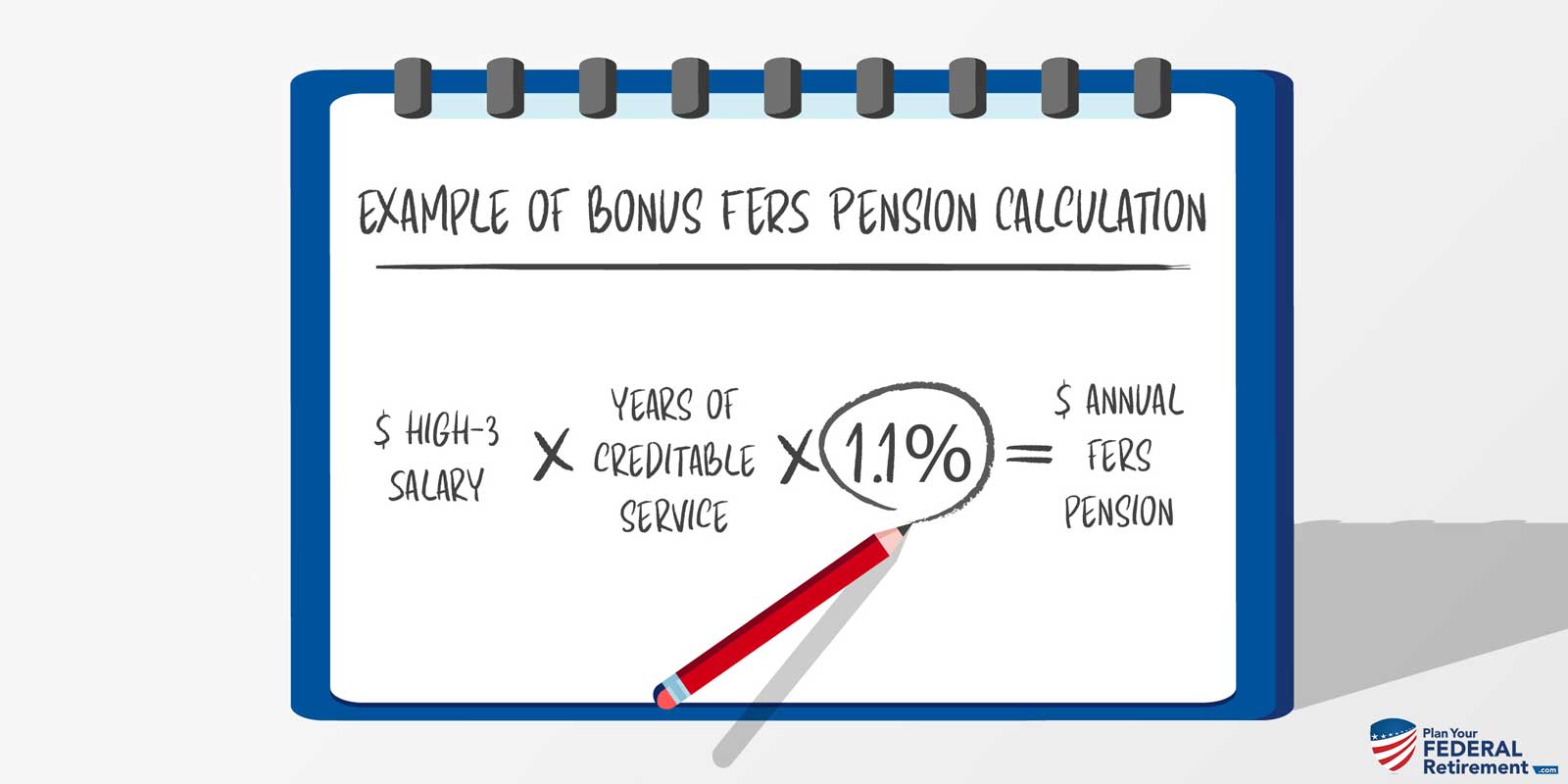

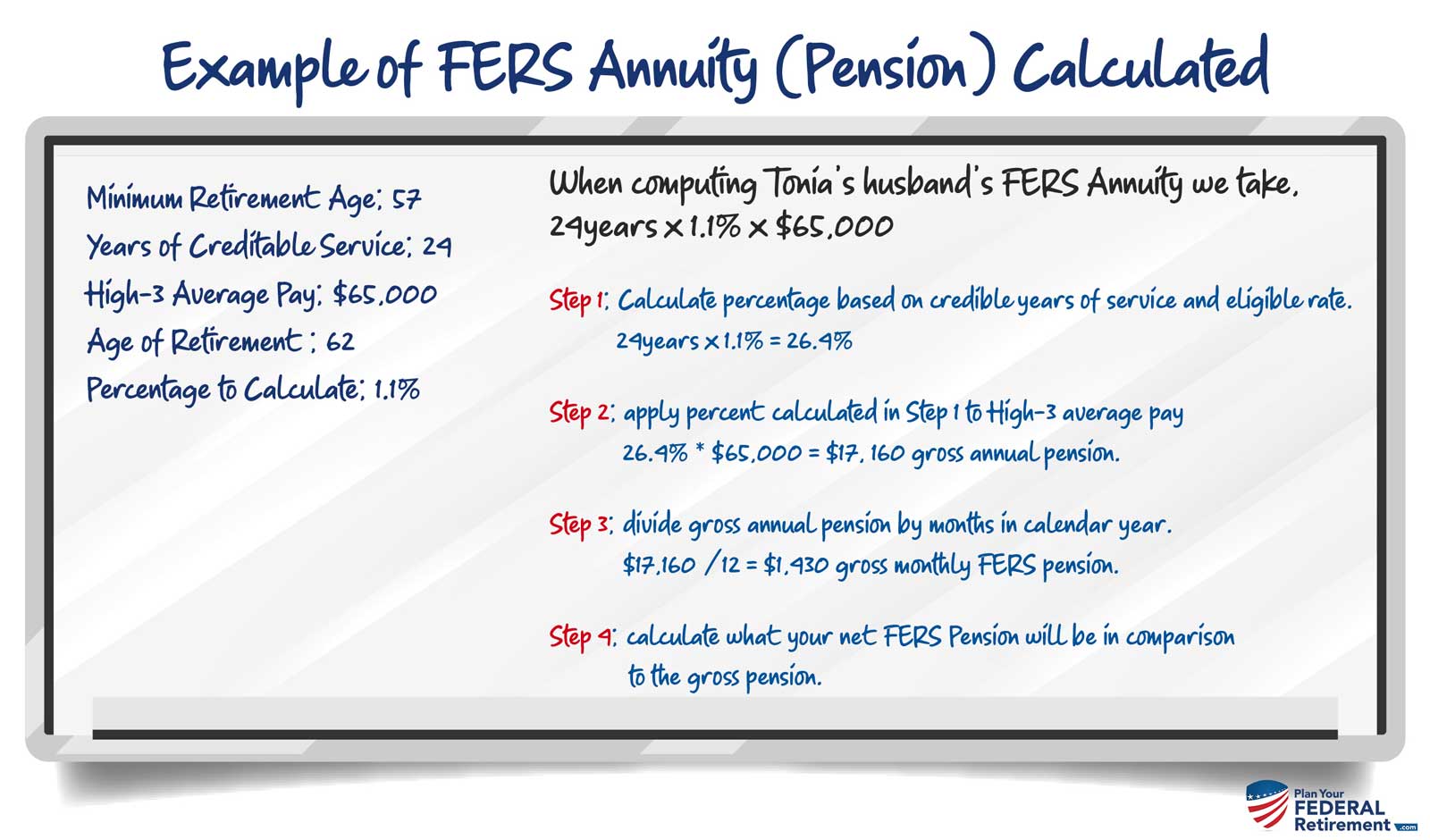

Fers retirement pension plan. MOAA built the calculator below to help retiring or separating members better understand what civilian salary theyll have to earn to realize the same take-home pay they had in the military. Retirement Services Calculators Federal Employees Group Life Insurance FEGLI calculator Determine the face value of various combinations of FEGLI coverage. Final Pay Calculator - This calculator estimates your retirement benefits under the Final Pay retirement plan for those members who first joined prior to September 8 1980.

The Consolidated Appropriations Act 2021 was passed and extended the period for collecting deferred 2020 Social Security taxes. Estimated Number of Years until retirement. Example of salary calculation incorporating both. Federal Retirement Plan Civilian Federal Retirement Plan FERS - Federal Employee Retirement System or CSRS - Civil Service Retirement System information may be found on your LES or pay statement.

The period for collection is now January 1 2021 through December 31 2021 instead of January 1 2021 to April 30. You also may need to account for civilian contributions to a 401k retirement plan health insurance and other expenses. If you first entered the military before Sep. RMC represents a basic level of compensation which every service member receives directly or indirectly in-cash or in-kind and which is.

Retired Military Annuitant Civilian Employee Contractor Vendor Home. My understanding is that Locality differential 35 and Hazardous Pay 35 is included when figuring out my highest three consecutive years of salary. I was a GS-13 then. Remember that this is just a first-level calculator.

Automatically calculates for High-3 or Final Pay depending on the date entered service - High-3 is for those. The method used depends upon when the member first entered military service. The high-36 method is the average of the highest 36 months of basic pay divided by 36. The reduction is 16 of 1 2 per year for every month that you are under age 55 at the time of.

Social Security Payroll Tax Deferral UPDATE. Military Retirement Calculator - Compare military retirement pay against different retirement dates and ranks estimate future pay for 40 years after retirement and automatically calculates early retirement pay if you enter a retirement date that is less than 20 years of service. FederalPays military pay calculator can calculate yearly pay for both enlisted servicemembers and officers in all branches of the United States armed forces - Army Navy Air Force Marines Corps and Coast GuardOur calculator also factors in location-based housing and food allowances and displays the taxable and tax-free portions of military compensation. Dod civilian retirement pay calculator.

This is generally the last 3 years of service and is sometimes called high-3. If you retire on a discontinued service retirement or early optional retirement because your agency was undergoing a major reorganization reduction-in-force or transfer of function and part of your benefit was computed under CSRS rules the CSRS portion will be reduced if you are under age 55. To qualify for disability retirement the Airmen must be deemed unfit for military service and have a disability rating of at least 30 percent. Pay and benefits for federal employees usagov.

Under this system your retired pay is computed by multiplying your final monthly base pay. In most cases Federal employees who first entered covered service on and after January 1 1987 are covered under FERS and those before January 1 1987 are covered under CSRS. 11 Definitions Eligibility 2 of 2 ELIGIBILITY To be eligible for an Air Force centrally funded retirement or separation move employees must be returning from an OCONUS location after completing. The monthly retirement pay begins immediately after retirement and.