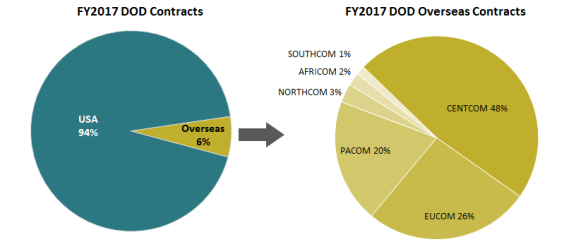

Dod Civilian Overseas Taxes

If you're searching for video and picture information related to the keyword you've come to pay a visit to the ideal site. Our website provides you with hints for viewing the highest quality video and picture content, hunt and locate more enlightening video content and images that fit your interests.

comprises one of tens of thousands of movie collections from several sources, particularly Youtube, so we recommend this video that you view. This site is for them to visit this website.

By Order of the Commander.

Dod civilian overseas taxes. Subscribe to RSS Feed. If you can receive mail there then yes please use your mothers address in Maryland for your 2016 tax returns. If you are a US. Members of the military do not need to write COMBAT ZONE and their deployment date.

Military and support personnel involved in military operations in a combat zone. MARCH 14 2019 Sembach Kaserne Germany - The Tax Cuts and Jobs Act passed in December 2017 made the majority of government civilian employee relocation e. Contractors especially military have different tax treatment than normal employed expats. If I am a DOD civilian working.

If I am a DOD civilian working in Germany do I have to pay state taxes in Idaho. However certain foreign areas allowances cost of living allowances and travel allowances are tax free. By filing Form 4868 Application for Automatic Extension of Time to File US. 1 2018 under the Tax Cuts and Jobs Act most civilian relocation allowances became taxable.

FBAR FinCEN 114 8938 FATCA comparison. 1 days ago DoD civilian working overseas do I file MD state taxes as resident or non-resident. How this affects federal civilian employees Navigating the Civilian PCS website The DFAS PCS Civilian Relocation page can help you with everything from understanding your orders to filling out your voucher and submitting to. Another upside is long-term storage of household goods and personal vehicle shipment allowances for overseas civilian employees is still tax exempt.

Missionary tax treatment will vary. Civilian taxpayers covered by the relief provisions described here should put the words COMBAT ZONE and their deployment date in red at the top of their tax returns. If you can receive mail there then yes please use your mothers address in Maryland for your 2016 tax returns. This link can help you understand how this may affect you.

Whether for personal or business reasons in order to secure the ability to exclude up to 100K from taxable income. 4621 aims to address a shortage of civilian workers staffing dangerous regions by extending a federal income tax break to those employees. That would seem to make the most sense. Citizens who are living abroad as civilians You must pay any tax due by April 15 or interest will be charged starting from April 15 5 IRS Tax Breaks for Military Members.

This regulation prescribes policy for authorizing overseas allowances such as living quarters allowance LQA. Email to a Friend. Some civilian federal employees whose overseas moves were paid by the government in the past year are sighing with relief. The Combat Zone Tax Parity Act HR.

How will my armed forces salary be taxed. Accordingly if you paid taxes on civilian relocation entitlements which were reported as taxable income on a 2018 andor 2019 W-2 or W-2C you are eligible to file a RITA claim. Therefore civilian contractors working abroad are limited to the Physical Presence Test. As a crown servant the salary and allowances you receive from the armed forces will continue to be taxed in the UK as normal.

DoD civilian working overseas do I file MD state taxes as. VIERGUTZ Chief Army in Europe Document Management. PFIC - Form 8621. As the IRS cautions servicemembers and US.

Here we look at the main tax considerations if you usually live and work in the UK but spend time working overseas. This is irrespective of the length of time you are outside the UK and whether or not you remain tax. Act 1984 so that an exemption from inheritance tax applies not only to NATO military and civilian personnel stationed in the UK or attached to a NATO headquarters in the UK but also to EU military and civilian staff attached to an international military headquarters designated under an Order in Council. The IRS has declared that a portion of that benefit is tax exempt.

I have not set foot in that state for the entirety of 2017. Agency Reimbursed By Foreign Country. New Member June 3 2019 1056 AM. The Relocation Income Tax Allowance RITA filing deadline has been extended to July 15 2020.

Most payments received by US Government civilian employees for working abroad including pay differentials are taxable. Paragraph 33 inserts into section 155. Individual Income Tax Return you can apply for a third tax filing deadline extension. Contractor Abroad Tax Guide.

As the IRS notes taxpayers can typically wait until at least 180 days after they leave the combat zone to file returns and pay any taxes due. Citizen or resident alien residing overseas or are in the military on duty outside the US on the regular due date of your return you are allowed an automatic 2-month. Civilian employees who opt for hazardous overseas duty often perform important jobs in fields such as transportation reconstruction and health care but do not qualify for income tax exemptions on their base pay like. DoD civilian working overseas do I file MD state taxes as resident or non-resident.

0 1 745 Reply. Financial reporting forms - similarities differences due dates and more. This will give you until October 15 to file. Non-US mutual fund investments may carry onerous tax implications.

Therefore you must closely track your time spent in the US. In addition to automatically extending the deadline to file a tax return for soldiers who are deployed overseas the IRS also offers an array of other tax breaks for. Civilian Personnel Overseas Allowances This regulation supersedes AE Regulation 690-500592 26 October 2017.