Dod Civilian Overseas Post Allowance

If you're looking for video and picture information linked to the keyword you've come to pay a visit to the right site. Our website provides you with hints for seeing the highest quality video and picture content, hunt and find more enlightening video content and graphics that fit your interests.

includes one of tens of thousands of video collections from various sources, particularly Youtube, so we recommend this video that you view. This blog is for them to visit this website.

As permitted by the DSSR the Department of Defense DoD has issued its own implementing regulations under DoD Instruction 140025- V1250 Overseas Allowances and Differentials.

Dod civilian overseas post allowance. The Post Allowance is just like the military COLA to offset goods and services purchased onthe local economy which aremore expensive than if purchased in the US. Family living in the foreign area. When the overall cost of goods and services at the foreign location are at least 25 above those in Washington DC. Not listed in Part 5 Table B used to prescribe the Post Allowance for civilians.

For more information refer to Allowances Differentials and Other Pay. There are a few situations where the member will get both such as when. Post allowance is a cost-of-living allowance granted to full-time employees officially stationed at a post in a foreign area where the cost of living exclusive of quarters costs is substantially higher than in Washington DC. A military member will either be provided base housing possibly a dorm or will be given BAH.

For your Service representative. While Department of State DoS is responsible for setting LQA rates your employing activity is responsible for determining eligibility under the regulations in DSSR Chapter 100 Section 130 and the DoD Civilian Personnel Manual - DoD 140025-M Subchapter 1250. Individuals stationed outside the United States will find details on international or foreign entitlements on the Department of States Standardized Regulations page. To receive Post Allowance you must submit a completed SF-1190.

Overseas Allowances and differentials except post allowance are not automatic salary supplements nor are they entitlements. Agency Reimbursed By Foreign Country. Post Allowance should be requested upon movement from temporary quarters to permanent quarters or if TQSA. Government civilians assigned to foreign areas.

The Department confirmed that some US. This regulation prescribes policy for authorizing overseas allowances such as living quarters allowance LQA temporary quarters subsistence allowance TQSA separate maintenance. They are specifically intended to be recruitment incentives for US. Department of Defense INSTRUCTION NUMBER 140025 Volume 1412 July 20 2012 USDPR SUBJECT.

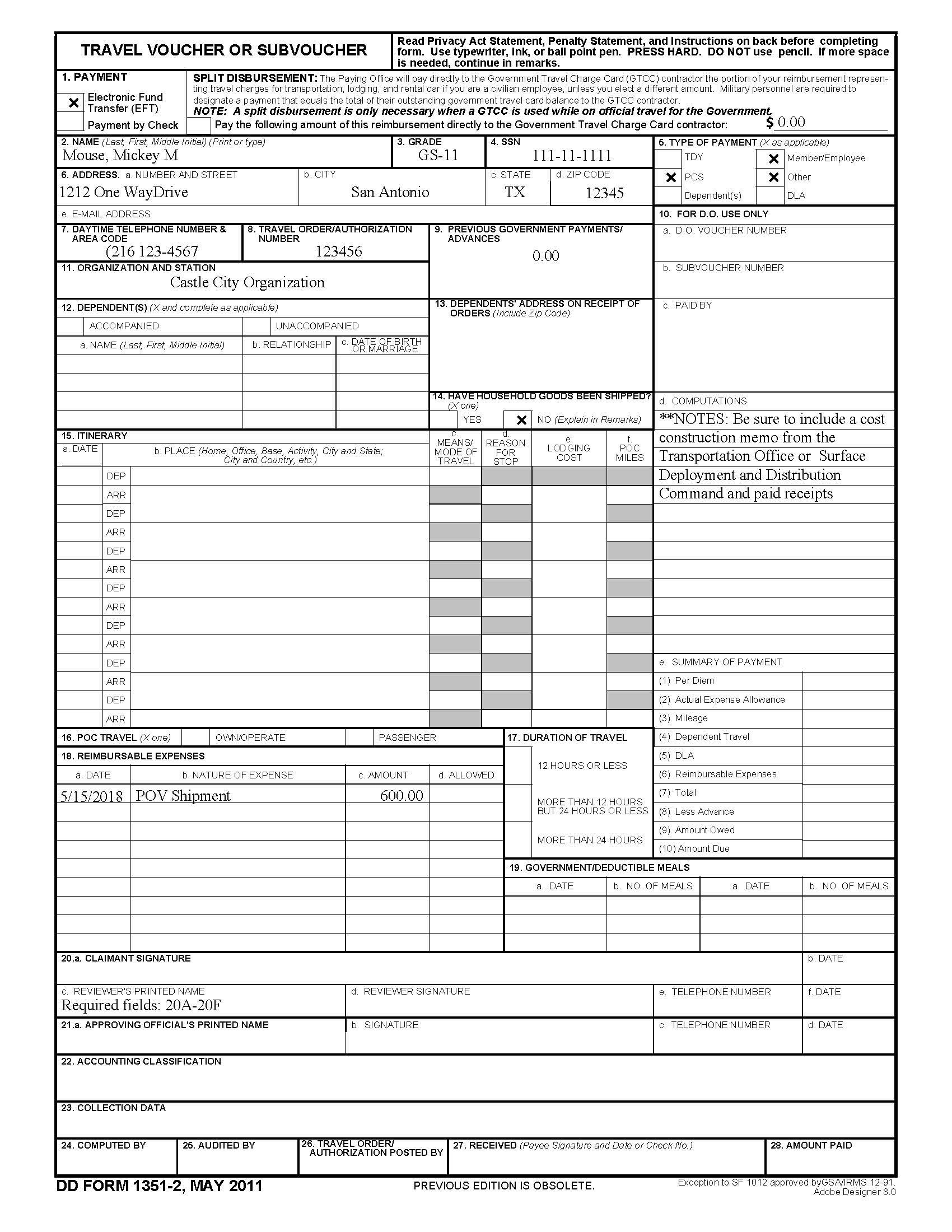

Provide completed documents to hrsv-noverseasentdlamil. As a civilian you may be eligible for pay entitlements or rights above and beyond Basic and Premium Pay. Countries with large numbers of duty stations need only. Post allowance is included in the computation of lump-sum leave payments upon separation from Federal service if.

Ranges for the post allowance are at DSSR 2282. Citizens hired overseas in DOD NAF positions were not paid Post Allowance in accordance with DOD policy and regulations. Family member wintersummer hire employees are not eligible for post allowance. Post allowance is not authorized at the same time an employee is receiving TQSA.

This Instruction is composed of several Volumes each containing its own purpose. The Department of State Standardized Regulations DSSR govern allowances and differentials available to US. Nonappropriated Fund NAF Overseas Allowances and Differentials and Employment in Foreign Areas References. However certain foreign areas allowances cost of living allowances and travel allowances are tax free.

Citizen employees living in the United States to accept Federal employment in a foreign area. To Request Post Allowance. LQA and utility allowance it will appear as LQA on LES and Post Allowanceyour will appear as POST ALLOW. Office of the Secretary of Defense OSD Military Compensation Policy DoD Overseas Station and Housing Allowance Process Guide 1212020.

Overseas Allowances and differentials except post allowance are not automatic salary supplements nor are they entitlements. See Enclosure 1 1. Citizen employees living in the United States to accept Federal employment in a foreign area. Post Allowance should be requested upon movement from temporary quarters to permanent quarters or if TQSA is not used upon arrival at the overseas duty location.

If the government provides the need the allowance is not given. To determine your eligibility or other questions pertaining to LQA please contact your CPOCPAC. The purpose of the. HOW LONG IT WILL TAKE TO RECEIVE POST ALLOWANCE.

Your entitlements may depend on your duty station location. DoD Civilian Personnel Management System. To receive Post Allowance you must submit a completed SF-1190. To receive Post Allowance you must submit a completed SF-1190.

They are specifically intended to be recruitment incentives for US. Part-time intermittent and US. Military COLA and the civilian post allowance both of which can change every two weeks depending on a number of factors including the strength of the dollar are calculated much the same. Post Allowance Post Allowance is a cost of living allowance that offsets the costs of goods and services at an overseas location as compared to costs in Washington DC.

Index 1025 or higher then a post allowance is established. Most payments received by US Government civilian employees for working abroad including pay differentials are taxable. The expenditure pattern is based on the average Washington DC.