Dod Civilian Change Tsp Contribution

If you're searching for picture and video information related to the keyword you've come to pay a visit to the right site. Our website gives you hints for viewing the maximum quality video and picture content, hunt and find more enlightening video content and images that fit your interests.

includes one of tens of thousands of movie collections from several sources, particularly Youtube, therefore we recommend this video for you to view. This blog is for them to stop by this site.

And sent to update your Federal Retirement Thrift Investment Board personal account information.

Dod civilian change tsp contribution. For more information about TSP see their website. This article is intended for military service members. TSP Contributions If you are a federal employee covered by the Federal Employees Retirement System FERS or the Civil Service Retirement System. You may change your Thrift Savings Plan TSP address information at any timeYou may make your address change through myPay if you are currently contributing to TSPYour TSP address change will be posted to your military pay account at the next update.

Department of Defense DoD employees may use the DoDs Employee Benefit Information System EBIS to stop or change TSP contribution amounts. The last time I changed my TSP contribution percentages amounts I used EBIS as follows. You can also make your own contributions to your TSP account and your agency will also make a matching contribution. Contributing 5 or more of your Basic Pay maximizes the matching government contribution for BRS participants.

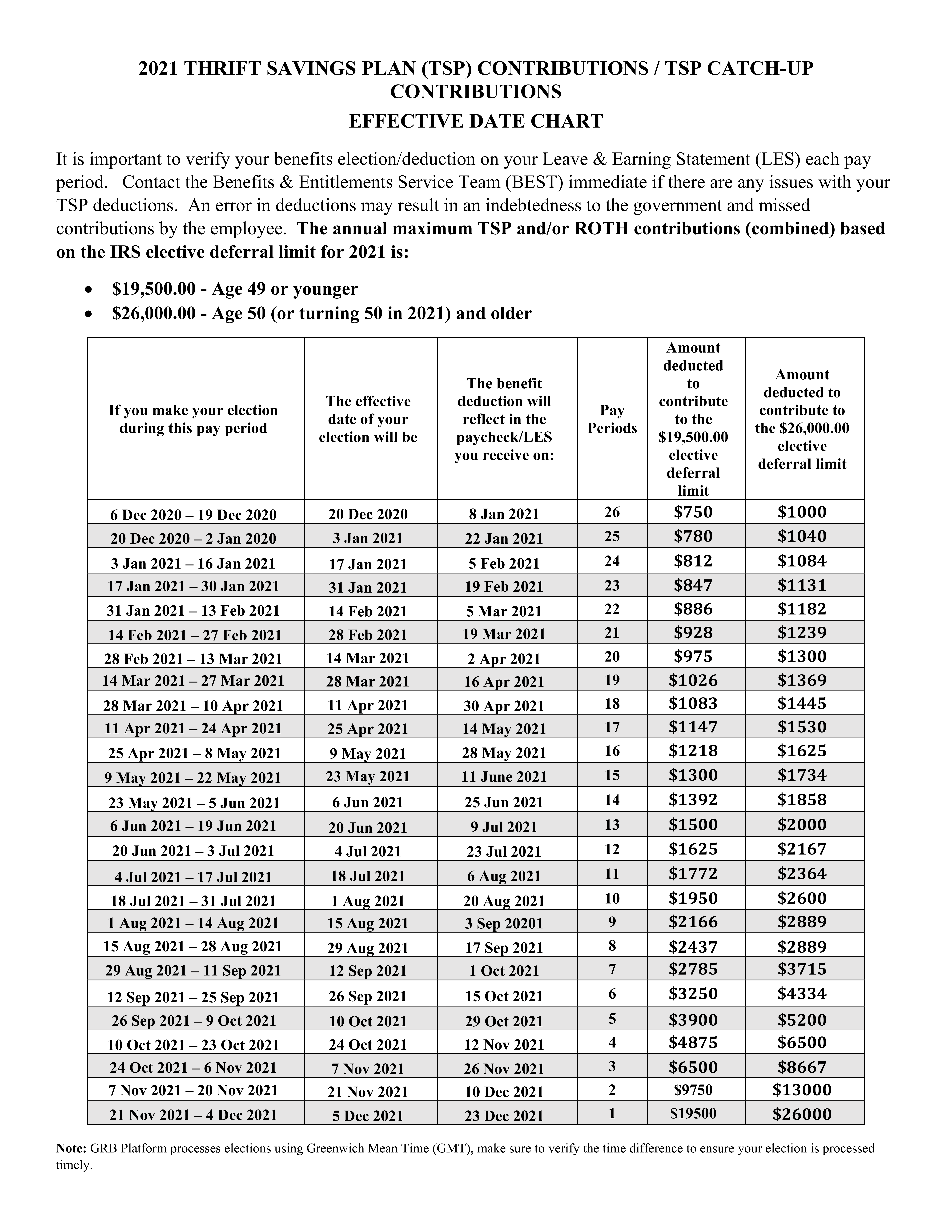

This change will take effect Oct. The GRB Platform is an automated secure self-service Web application that allows employees to make health insurance life insurance and Thrift Savings Plan contribution elections review general and personal benefits information and calculates retirement estimates. Your Leave and Earnings Statement should reflect your TSP deductions within two pay periods. This is different from the CSRSFERS defined benefit programs as benefits received from your CSRS or FERS annuity are based on years of.

Civilian government employees should contact. How do I start change or stop my contributions to the TSP. For example civilian payroll systems include Employee Express EBISGRB LiteBlue myPay and NFC EPP. New active duty and reserve military members and new federal civilian employees who are covered by the Blended Retirement System BRS will now automatically be enrolled in the Thrift Savings Plan TSP at five percent of their basic pay.

You might want to change your Thrift Savings Plan TSP contributions especially if you are in the Blended Retirement System BRS and are not yet contributing at least 5 of your Basic Pay to your TSP. Thrift Savings Plan TSP The TSP is a retirement savings and investment plan for civilian employees of the United States Government and members of the uniformed servicesTSP is similar to a 401K plan offered by many public and private corporations. According to a proposed rule posted Friday to the Federal Register beginning October 1 all new federal employees and military service members automatically will contribute 5 of their salary to. If you are currently contributing 10 of your salary and want to contribute 12 from here on you up the amount that you are putting.

TSP address for active Army Navy Air Force. First you can change how much you are contributing to the TSP. TSP is a retirement option for federal employees and military members providing similar tax breaks and savings to those offered in the private sector under 401k programs. In 2012 to protect personally identifiable information employees can only access EBIS from a mil edu or gov environment.

There is a traditional TSP and a Roth TSP option and while some military members may choose simple straightforward retirement plans others may prefer more complex arrangements taking advantage of both. GRB has replaced the Employee Benefits and Information System EBIS. These contributions are tax-deferred. The TSP is a defined contribution plan which means the retirement income you receive from your TSP account will depend on how much you and your agency if you are a FERS employee have contributed to your account and the earnings on those contributions.

The contribution allocations are different with the Roth TSP option. From the Transactions page in the TSP Current Coverage section select Change. You may start change or stop your contributions any time after your first full pay period in pay status. Start change or stop contributions In most cases youll use your agencys or services electronic payroll system to start change or stop your TSP contributions.

For example civilian payroll systems include Employee Express EBIS LiteBlue myPay or NFC EPP. To make up missed TSP contributions you must submit a written request to your agency within 60 days of the date of your reemployment in or restoration to civilian service. If you are automatically enrolled after October 1 2020 your agency will deduct 5 from your basic salary before taxes every pay period and deposit it into your TSP account unless you make an election to change or stop these contributions1. Submit a written request to your agency within 60 days of the date of your reemployment or restoration to federal civilian service to make up your eligible missed TSP contributions.

Log into EBIS select Transactions from the horizonal menu bar at the top. In most cases youll use your agencys or services electronic payroll system to start change or stop your TSP contributions. The Thrift Savings Plan is administered by the Federal Retirement Thrift Investment Board. The easiest way to change the amount of your TSP contributions is by using the Government Retirement Benefits GRB Platform.