Do Federal Employees Get Cola Overseas

If you're looking for picture and video information related to the key word you've come to visit the right site. Our site provides you with hints for seeing the maximum quality video and picture content, search and find more informative video articles and graphics that match your interests.

includes one of tens of thousands of movie collections from various sources, especially Youtube, so we recommend this video that you see. This site is for them to visit this website.

Do your family members also.

Do federal employees get cola overseas. The base salary does include the Overseas Comparability Pay. It affects approximately 250000 Service members at 600 locations overseas including Alaska and Hawaii. Dean an Air Force NAF employee has long believed that he and other Americans hired overseas were eligible for post allowance. Only active duty military personnel get BAH.

Is the post allowance taxable. However those working abroad also receive travel and moving expenses to and from their foreign posts and most have their basic living expenses such as housing paid as well. Department of Defense DOD guidelines state that US. The COLA is a non-taxable supplement based on average pay and the cost of housing for the local population.

It depends on location rank and number of dependents and may change from paycheck to paycheck based on fluctuations in the exchange rate. The Defense Department released the 2020 Continental United States CONUS Cost of Living Allowance COLA rates which take effect Jan. In some cases employees receive. Government pays cost-of-living allowances COLAs to white-collar civilian Federal employees in Alaska Hawaii Guam and the Northern Mariana Islands Puerto Rico and the US.

Citizens recruited in the United States for NAF employment overseas are entitled to COLA but NAF employees hired locally in an overseas area are not eligible. Do you get the following. If not the increase is prorated under both plans. While the State Department is responsible for setting foreign per diem rates per diem travel policy both foreign and domestic is governed by the Federal Travel Regulation FTR and not by the DSSR.

The Overseas Cost of Living Allowance is the militarys answer to its members being stationed in various places throughout the world where the cost of living is higher. Section 5941 of title 5 United States Code and Executive Order 10000 as amended authorize the payment. Approximately 2 billion is paid in Overseas Cost of Living Allowances annually. Employees is prescribed in.

Act 5 USC 5924 US. Access to the PXCommissary. This distinction does not apply to appropriated fund employees. Ask Question 100.

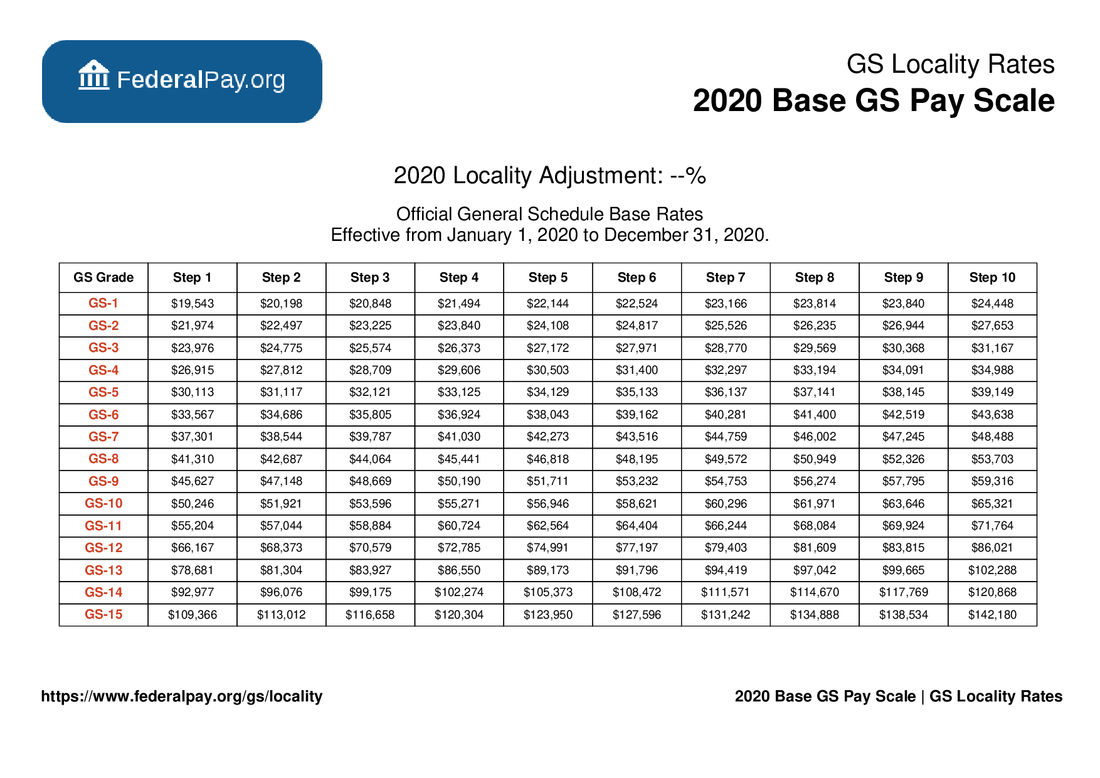

Join Yahoo Answers and get 100 points today. Employees paid on the General Schedule GS and the Law Enforcement Officer LEO Schedule receive a percentage increase to their salary to compensate for the different costs of living Across the US. This will be just a GS employee no military partner Ive been looking online but it dont give a clear answer to what you receive overseas. The foreign travel per diem allowances provide for lodging meals and incidental expenses when an employee is on temporary duty overseas.

GS employees make enough in salary that they do not need any additional allowances. Get your answers by asking now. Overseas salaries are based on the same General Schedule that dictates the pay scale for employees based in the US and the benefits match those provided to all civil service employees. Cost-of-Living Adjustments were first prorated in April 1982.

To assist employees in calculating the amount they might receive on a biweekly basis the Office of Allowances has created a COLA Calculator which is available on our website on the Post Allowance COLA page. The Overseas Cost of Living Allowance COLA is a non-taxable allowance designed to offset the higher overseas prices of non-housing goods and services. Are there any GS people on here that can tell me the basics of what benefits GS employees receive. Section 5941 of title 5 United States Code and Executive Order 10000 as amended authorize the payment of COLAs in nonforeign areas.

Federal employees assigned to a foreign post are typically compensated differently compared to those stationed within the continental United States. It is expressed as a percentage but is a flat annual rate based on the employees pay and the number of family members eligible for the. Adjustments to benefits for children are never prorated. This allowance helps service members afford the higher living expenses incurred at some overseas installations.

This page describes the allowances and differentials commonly associated with overseas service and available to employees in the civil service ie appointed under Title 5. The allowance paid to qualifying employees to offset the high cost. Employees should check their individual agencys. COLALocality Pay for Federal Workers in Hawaii and other Non-Foreign Areas Background.

The COLA allowance is a cost of living allowance to offset the difference between the cost of living at the post of assignment in a foreign area and the cost of living in the Washington DC area. Government pays cost-of-living allowances COLAs to white-collar civilian Federal employees in Alaska Hawaii Guam and the Northern Mariana Islands Puerto Rico and the US. Eligibility for post allowance payments to US. The Department of State determines when and where post allowances are needed through periodic cost-of-living surveys.

Each year the federal government calculates the cost of living in 33 different regions and the Rest of the US. To get the full COLA a retiree or survivor annuitant must have been in receipt of payment for a full year.