Department Of The Army Tax Exempt Form

If you're searching for video and picture information related to the key word you have come to pay a visit to the ideal blog. Our site provides you with hints for viewing the maximum quality video and image content, search and find more enlightening video content and graphics that fit your interests.

comprises one of thousands of movie collections from several sources, especially Youtube, so we recommend this movie for you to see. This blog is for them to visit this website.

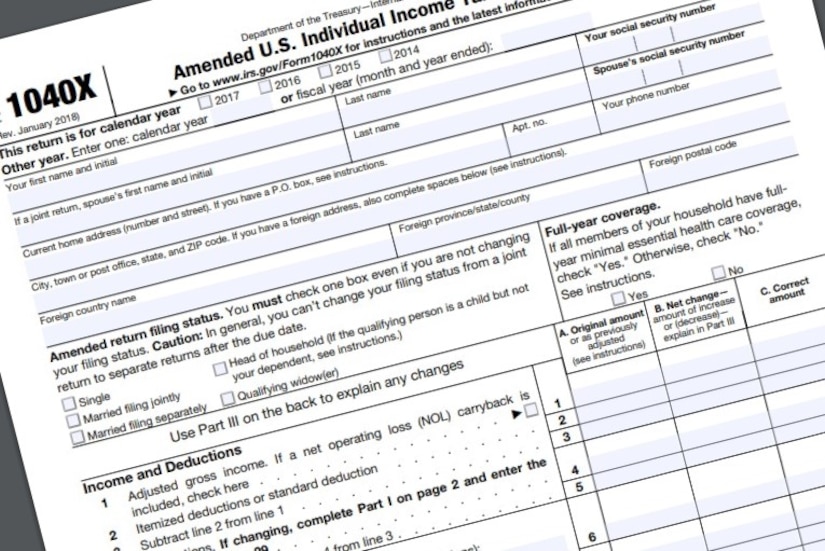

Choosing Your Income Tax Form.

Department of the army tax exempt form. Read the following to see which set of circumstances fits you. The Coast Guard is also included but not the US. Are Service members and civilian employees exempt from hotel or occupancy taxes. Military spouses who fall under this law should file Form 740-NP Kentucky Individual Income Tax Nonresident or Part-Year Resident Return to request a refund of the Kentucky income tax withheld from his or her pay.

Tax Exemption FAQs Updated. Another one wont hurt and at least its for a good cause. Armed Forces includes officers and enlisted personnel in all regular and reserve units controlled by the Secretaries of Defense the Army Navy and Air Force. If a military member was a Kentucky resident at the time he or she joined the military but is now stationed outside of Kentucky he or she is still considered a Kentucky resident for income tax purposes and should file Kentucky Form 740.

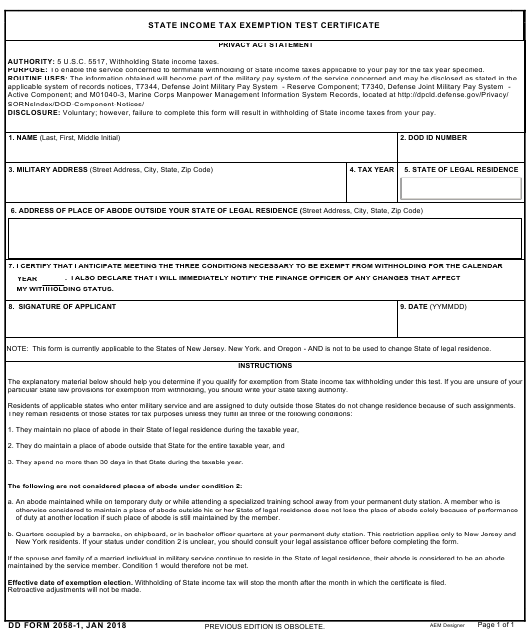

Several states and cities. Filed a joint federal income tax return and your spouse is also a. SF1094 United States Tax Exemption Form. This shouldnt bother you too much youve filled out hundreds of forms in your career.

No Service members and civilian employees are not exempt from state and local tax on items such as meals or rental cars. However these and other support personnel may qualify for certain tax deadline extensions because of their. To assist the Kentucky Department of Revenue in identifying those returns please check the box labeled. This includes all military pension income regardless of where you were stationed or domiciled while on active duty.

Merchant Marine or the American Red Cross. This exclusion is unlimited for enlisted members and warrant officers and is limited to 736830 per month in 2009 for officers. The income is not reported as taxable on the Kentucky income tax return. If you spend a single qualifying day in the combat zone your pay for the entire month is excluded from taxable.

Your vehicle tax reminder letter V11 if you have one. If thats the case just claim. Government meets its obligations under Article 34 of the Vienna Convention on Diplomatic Relations and Article 49 of the Vienna Convention on Consular Relations as well as other similar treaties and agreements to provide exemption from state and local sales restaurant lodgingoccupancy and other similar taxes. You need to take.

State tax information may be found on the websites of your state revenue or tax department. For federal tax purposes the US. These states join others exempting all or part of military pay for eligible members. Kentucky New Mexico Minnesota and Oklahoma instituted new tax guidelines in 2010 exempting certain military pay from state taxes for legal residents.

Foreign missions may not. And the state is using that to recruit retiring servicemembers to Indiana. California law conforms to Federal law which determines the tax treatment of Veterans Affairs VA disability benefits. Earnings received while in the combat zone are excluded from taxable income.

If you have any questions pertaining to the VAT exemption of the AAFES Purchase Card please contact the Helpline on Telephone. The Department is the only entity in the United States with legal authority to authorize diplomatic and consular tax exemption privileges. Are Service members and civilian employees exempt from state and local taxes on items such as meals or rental cars. Being assigned to or working in a combat zone triggers another tax advantage.

Filed a separate federal income tax return file a separate Indiana return on Form IT-40. Veterans military pensions will be 100 exempt from Indianas income tax in the next four years. If you are married and. Choose a link below to begin downloading.

MilTax Military OneSources tax service provides online software to electronically file a federal and up to three state tax returns for free regardless of income. Military OneSource a program offered by the Department of Defense provides a range of free resources for military members veterans and their families. The civilian spouse of a servicemember who is exempt from Ohio income tax under federal law should request an exemption from Ohio withholding from hisher employer by submitting Ohio form IT 4 to said employer. Apply for a vehicle tax exemption Apply at a Post Office that deals with vehicle tax.

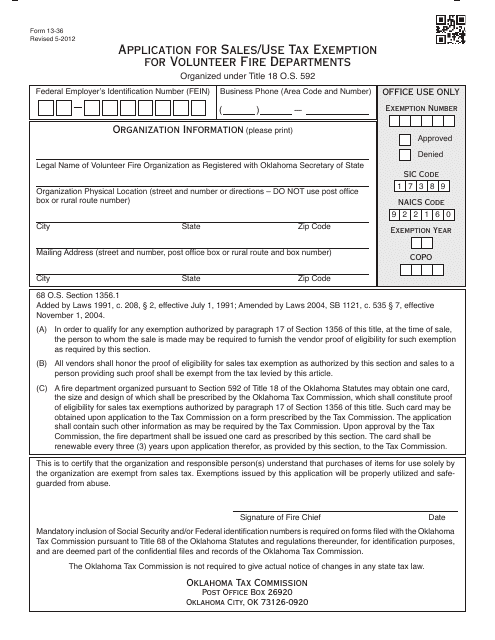

Up to 15000 of military basic pay received during the taxable year may be exempted from Virginia income tax. Through the Department of States Diplomatic Tax Exemption Program the US. GSA-FAR 48 CFR 53229. If you are single file Form IT-40.

0300 200 3700 or by email using the appropriate form available on the. The active duty military pay exemption applies to all Kentucky servicemembers regardless of where the servicemember is stationed. This form shall NOT be used for. This form will be used to establish the Governments exemption or immunity from State or Local taxes whenever no other evidence is available.

The Department has learned that foreign missions have been providing written documentation to various vendors and tax authorities in the United States which states that certain members of the embassy are exempt from taxation. The log book V5C in your name. Retirement pay is reported on IRS Form 1099-R. - You may need to fill out a lodging tax exemption form depending on the state or territory and present it at check-in.

For every 100 of income over 15000 the maximum subtraction is. SF1094-15cpdf PDF - 1 MB PDF versions of. A servicemember who is exempt from Ohio income tax under federal law should request an exemption from Ohio withholding by submitting Ohio form IT 4 to hisher employer.