Can Dod Civilians Get A Va Loan

If you're looking for video and picture information linked to the key word you have come to visit the right blog. Our site provides you with suggestions for viewing the maximum quality video and image content, hunt and locate more informative video content and images that match your interests.

includes one of thousands of video collections from various sources, particularly Youtube, so we recommend this video for you to view. This blog is for them to stop by this site.

Whomever is on the loan will be on title.

Can dod civilians get a va loan. Additionally because the government guarantees the lender repayment it requires no mortgage insurance like you would need to purchase on a traditional one. Because the government is backing up the money that is loaned to you the VA home loan is written at substantially lower rates of interest than traditional loans written out to civilian borrowers. For National Guard and Reserves Members Those serving in the National Guard or the Reserves have a minimum six-year duty requirement. Co-borrowing is not the only area that gets a bit tricky when it.

In addition civilian co-borrowers must not have a disproportionate share of the financial burden on the VA mortgage. OTH discharges can be accepted in-lieu of court-martial proceedings at the service-members request. Certain exceptions are made for qualifying surviving spouses of service members who have died as a result of military service but in general the non-VA loan eligible borrowers cannot apply for VA mortgages including refinance loans. Active duty military veterans surviving spouses and in some instances civilians are eligible for a VA loan.

The veteran cannot retrieve the remaining eligibility until the. This concern stems from correct knowledge that a VA borrower is only eligible to get a loan on the home they use as their primary residence and that VA loans are typically restricted to one home at a time its hard to use two different homes as primary residences. The Vendee Financing Program offers homes that can be funded with no money down if the home is owner-occupied and can be financed with only 5 percent down if it isnt occupied. In my civilian career as a loan officer I still take care of soldiers but now it is with their home loan needs.

If it cannot be taxed or legally classified as real estate you cannot purchase it with a VA mortgage. You have a steady income you and your family are entitled to full medical benefits depending on how long you have been in service and you can get things that civilians cant. There are many advantages of being in the military. VA loans cannot be issued to non-military borrowers on the original mortgage including the spouse.

The reservist served in active duty for more than 90 days during wartime. The short answer is no. Once theyre the property of the VA they are pooled together and become available for sale not only to military personnel but to civilians as well. Is to take care of soldiers.

Persons facing OTH are guaranteed by the Uniform Code of Military. Get a mortgage quote today. Gresham Mortgage Loan provider. I speak your language.

These loans can be fully guaranteed by the VA. OTH discharges are typically given to service members convicted by a civilian court in which a sentence of confinement has been adjudged or in which the conduct leading to the conviction brings discredit upon the service. Im going to also say what I would say to my son who is Military I would not recommend that you add a girlfriend to either. If you need to write your will are considering signing a lease or need a power of attorney or notarized signature then you need legal assistance and best of all military service members and.

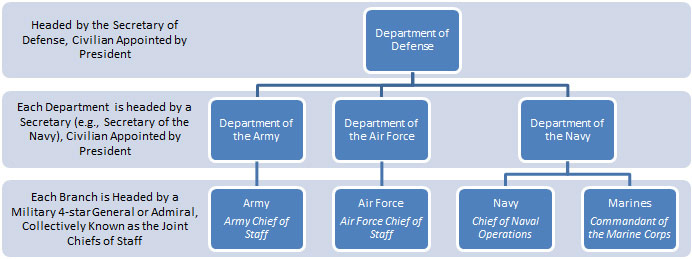

However if you are otherwise qualified for a VA home loan your status as a federal employee will not disqualify you. If the loan closed before March 1 1988 it is assumable no matter what. There are about 796000 DoD civilians in the US but about 221000 of those employees already have exchange benefits resulting from another beneficiary category such as retiree or military. Lower Interest Rates Than Civilian Loans.

The reservist was released from active duty or discharged because of a service-related disability. If a civilian buyer assumes the VA loan the remaining portion of the sellers VA entitlement in use stays with the original loan. VA Minimum Property Requirements for VA Home Loans The VA guidelines recognize legally married spouses of qualified veterans as co-signers on VA loans and lenders can include their income. You you can have someone on title that is not on the loan.

One of them is home loans that are guaranteed by the government and these are approved much more often than regular loans. VA loans have requirements the veteran must fulfill before they can be considered eligible. VA will only guaranty the military members portion of any home loan between a vet and non-veteran. I understand the pay system and know all of the ins-and-outs of the military.

This is true even if you were posted to a combat zone in your capacity as such a civilian employee. I believe A non veteran can be on a VA loan as long as the primary has VA entitlement. The VA guidelines will allow for more than one eligible veteran to purchase a home. That is why RVs campers houseboats and other vehicles are ineligible for VA loans.

The veteran applicant is expected to have a more or less equal financial stake in the purchase of the property. Now VA loans are only assumable in certain circumstances. You cannot qualify for a VA home loan solely on the basis of being a Department of Defense civilian employee. Once upon a time all VA loans were assumable whether the new buyer was military or civilian.

Another advantage of being in the military. If the VA loan closed after that date loan assumption is not allowed unless the veteran.