Army Counseling Financial Indebtedness

If you're looking for picture and video information linked to the keyword you've come to visit the ideal site. Our site provides you with suggestions for viewing the highest quality video and picture content, search and find more informative video articles and images that match your interests.

includes one of tens of thousands of movie collections from various sources, especially Youtube, therefore we recommend this video that you view. It is also possible to bring about supporting this site by sharing videos and graphics that you like on this blog on your social networking accounts like Facebook and Instagram or educate your closest friends share your experiences about the ease of access to downloads and the information you get on this website. This blog is for them to visit this site.

Credit problems happen to military members for many reasons.

Army counseling financial indebtedness. Counseling one of the most important leadership and professional development responsibilities enables Army leaders to help Soldiers and Army Civilians become more capable resilient satisfied and better prepared for current and future responsibilities. The Army Regulation that governs Soldier and leader responsibility and actions regarding financial and debt management is AR 600-15 Indebtedness of Military Personnel. Is the soldier over extended in finances. Financial counseling is usually done by phone but can happen in person or online.

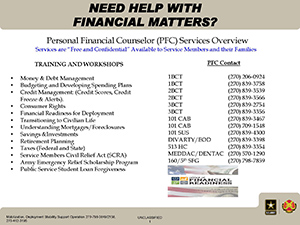

Developmental counseling statement sample covering Indebtedness. Services include classes on money management credit financial planning insurance and consumer issues. Root cause for the lateness on payments. Through partnerships with non-profit corporations many of these tools and.

Here are some issues that lead to problems for. If you need advice I am always available. The program covers indebtedness consumer advocacy and protection money management credit financial planning insurance and consumer issues. Follow-up with the chain-of-command monthly until the financial problem is taken care of.

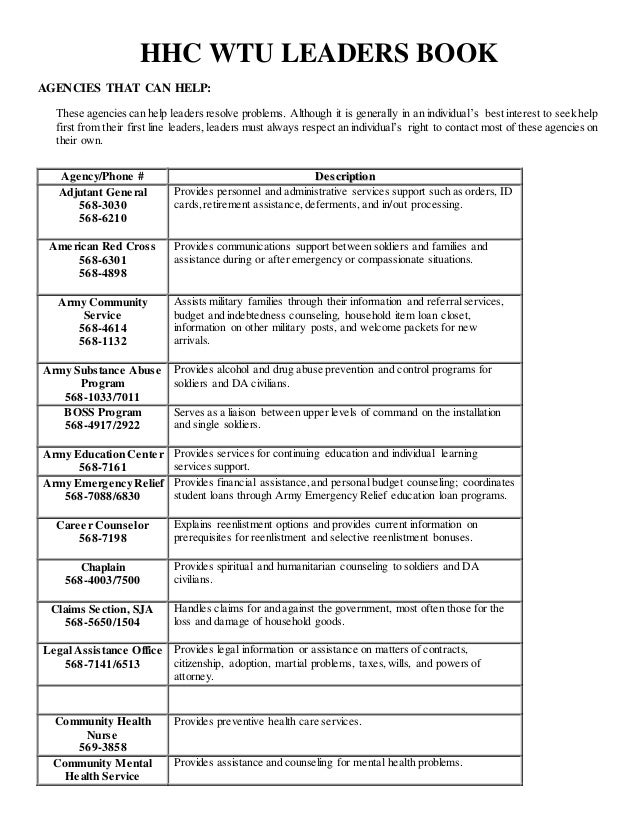

We need more examples. Due to their nature financial problems take time to overcome and I know it will take time. Army Community Service. Chapter 2 paragraph 2-1 AR 600-15 provides detailed guidance to commanders in processing debt complaints.

It also addresses events such as noteworthy duty performance an issue with performance or mission accomplishment or a personal issue. Counseling is the process used by leaders to review with a subordinate the subordinates demonstrated performance and potential. It may precede events such as participating in promotion boards attending training courses and preparing for deployment or redeployment. Stick with the budget until the financial problem has been resolved.

Financial Readiness Program FRP Provides comprehensive educational and counseling programs in personal financial readiness. Thanks for your contributions. Changes to pay and benefits during COVID-19. Rest assured Military OneSource financial counselors will not push products or plans on you.

AFCs have skills to assist individuals and families in the complex process of financial decision making including the ability to educate clients in sound financial. 3 Provide financial management counseling for Soldiers that have problems in meeting valid debts. DA Form 4856 for Financial Counseling. Army Community Service ACS FRP teaches Soldiers in both classroom training individual counseling sessions how to save and invest their money how to establish savings goals debt elimination strategies and saving for emergencies.

To share examples enter them below and click Submit. Financial counseling gives you an opportunity to talk to a trained professional one who is familiar with the issues that affect service members about your questions and receive referrals to services and programs that meet your specific needs. Back to Event-oriented Counseling. Event-oriented counseling involves a specific event or situation.

The Armys Financial Readiness Program FRP is available at every installation. Determine whether the Soldier is in compliance with the support requirements. The regulation should begin with a general statement of Army policy on indebtedness. Does the soldier have a budget set up.

This is only an example for you to use as a guide Schedule an appointment for the soldier with the Unit Financial Advisor. What creditors are late receiving payments. The important thing is to get started. I will ask the First Sergeant to call the ACS to see if you are eligible for financial relief.

2 Processing debts basically amounts to formally informing the Soldier of the claim of indebtedness against them. The Association for Financial Counseling and Planning Education AFCPE Accredited Financial Counselors AFCs work with clients in a financial counseling or education setting to assess and improve their financial decision making. Service members can access financial counseling for free through installation programs and Military OneSource. Financial counseling can help by.

11 General Each subject covered by this guide contains a short explanation and reference documents in order to highlight a DA Regulation where to go for additional information and outlines basic commander responsibilities. Determine the appropriate form and timing of financial payments in accordance with AR 608-99 para 2-7. Research and make financial counseling resources. Direct compliance by counseling the Soldier in writing.

Soldiers are expected to pay their just financial obligations in a proper and timely manner but the Army has no legal authority to arbitrate or resolve personal disputes over debts to require a Soldier to pay debts or to divert any part of a Soldiers pay to satisfy a private debt. All leaders need to read this regulation in order to know and understand the parameters of their Soldiers and their own responsibility. Think twice before assuming any new debt. Talk to a financial counselor.

Find answers to your questions about how changes. See FM 6-22 Army Leadership Appendix B for more information on counseling. The misson of FRP is to reduce indebtedness and requests for emergency financial assistance and to prevent financial difficulties before they arise through classes on money. Helping Veterans and Active Military Members Improve Bad Credit.

The misson of FRP is to reduce indebtedness minimize the need for emergency financial assistance and prevent financial difficulties. Other services offered are mandatory First Duty Station Training for First-Termers First-Termers Financial Planning Course at. The Financial Readiness Program FRP promotes readiness by counseling and educating Soldiers and Families in all areas of consumer and financial topics and ensuring that emergency assistance is available when needed. If you got em they can be shared by using the form below.

Possible Key Points To Discuss During Counseling. The number of counseling sessions is unlimited so theres no reason not to call for help if your financial needs change over the years. This policy statement. Confirm to the Soldier that a financial obligation to provide support exists.